Why GST 2.0 Could Reignite Indian Consumption

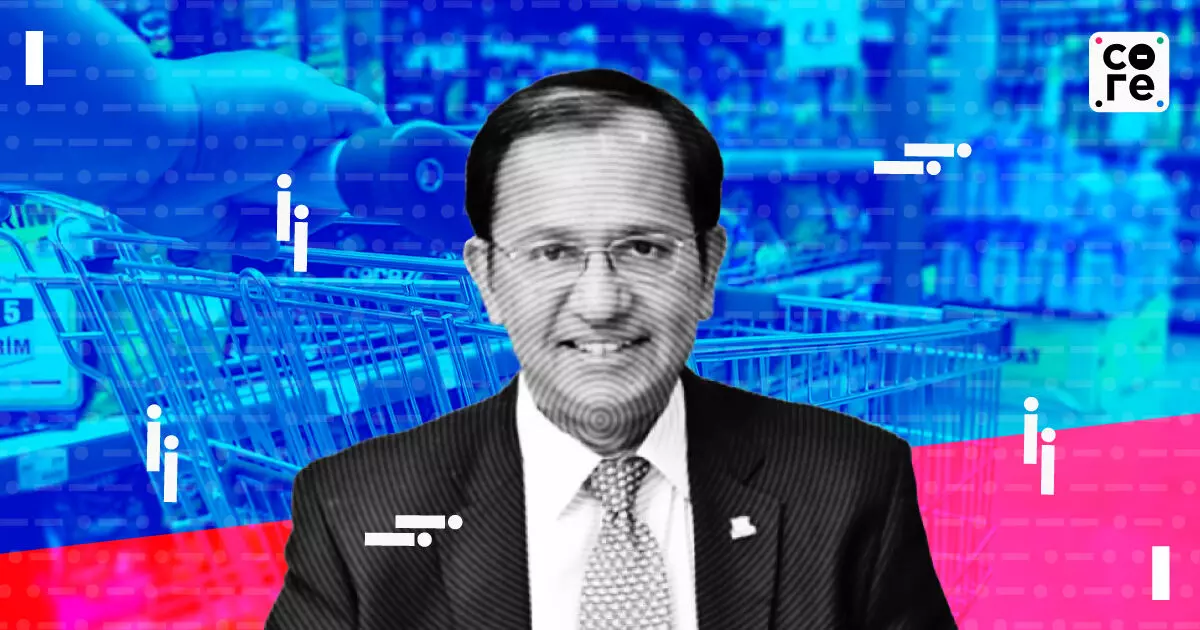

In this week's The Core Report: The Weekend Edition, Govindraj Ethiraj speaks to Suresh Narayanan, former chairman and managing director of Nestle on tax cuts, easing inflation, and shifting consumer priorities that may finally revive discretionary spending across middle India.

NOTE: This transcript contains the host's monologue and includes interview transcripts by a machine. Human eyes have gone through the script but there might still be errors in some of the text, so please refer to the audio in case you need to clarify any part. If you want to get in touch regarding any feedback, you can drop us a message on feedback@thecore.in.

Mr. Narayanan, thank you so much for joining me. So, before we kick off, I thought I will ask you about the latest round of GST rate cuts that we have seen. How would you interpret their impact on items of daily consumption, particularly of the kind that you have dealt with in Nestle?

Thank you, Govind. Thank you for having me on your show. I think, you know, off the bat, I would say that this is a very welcome step, Govind, that has been taken.

Two reasons. One is that I think inflation, especially poor inflation, has been impacting the lives of middle India quite considerably in these past years. And that has also led to a kind of recalibration of their budgets, away from more discretionary products into more essentials.

I think the reduction in the number of slabs and also the sharp reduction that has been done in everyday items is definitely a welcome step in order to stimulate consumption, given that consumption is the mainstay of the GDP. So, I think it is a very good step. And together with the mitigation of inflation as it were, even before the step, this can only accelerate the pace of consumption and bring back some of the zip in the economy that we needed for a long time.

And when you say that, you know, people had started switching from discretionary to essentials and we could see some of that switch back. Can you illustrate that switch that's happened because of inflation or inflationary pressures from your vantage point?

See, one of the things, Govind, that has been observed, and I think there is enough evidence to show that, is that the pattern of consumption expenditure also has been changing over the past years. You know, food has always been a dominant part of the consumption expenditure. And then followed by rental, education, non-discretionary items, etc.

Now, one of the things that has been happening is that because of the very high rentals and the real estate boom that has been taking place in some of the urban centres, the rental component and the education component has been increasing at the cost of some of the other what one would call essential or discretionary items of expenditure. Now, hopefully, with the reduction in the GSTs, which has been quite sharp, it will stimulate some of the long lost capabilities at balancing the budget through lower prices. And that will clearly for some of the essential products because many of us, I recall at Nestle when I was the head of the company, we were bitten by a lot of high commodity inflation, whether it was coffee or cocoa, or oil complex or wheat, or even milk for that matter.

And the result is that we had to take, if you are not able to mitigate some pretty sharp price increases that obviously came with the bill of reduced consumptions. Hopefully, that trend will now get reversed over a period of time.

And if you were to look between, let us say, the price rise in the inputs versus the pressure that consumers have been facing on their own budgets, what would you say has been more prominent or dominant?

Look, I think till these rate cuts have been made, the input cost increases have really been on top of the mind of most consumer marketeers and also in fact, even consumers. And therefore, that has led to a sharp shrinkage as far as consumption itself is concerned. I think on average, the reduction in the GST because of the banding effect that has taken place is anywhere between 500 basis points to about 700, 800, 900 basis points.

So, that is fairly substantial and certainly takes care of mitigating a lot of the commodity inflation that has been faced. And incidentally, even commodities, and here I am referring to largely food commodities, seem to be on even keel at the moment. In fact, with marginal declines in some of the exacerbated levels that we have seen.

So, hopefully, this will generally mean a relief for the average Indian consumer.

And one of the objects of my conversation today with you is to understand how consumer behaviour has changed, if so. So, let me pick up on the point that you made just now.

You said that one reason why there has been a shift this time around is because of the high cost of real estate that people are bearing. It could be in the form of loans or it could be in the form of rents. And the second, of course, is the cost of education, which people are obviously spending more on because they are spending more in general as well, apart from the fact that the cost is going up. So, how does this contrast with previous periods and previous, let us say, consumer spending trends?

Look, firstly, Govind, the kind of levels of inflation that we were seeing were kind of unprecedented. I mean, I do not recall in the past years, food inflation of 10 to 12 percent on vegetables and fruits, for example, 15, 16, 20 percent levels of inflation. Obviously, people and the real wage increases also, at least what has been indicated in the media, has been muted.

So, with the real wage increase, which is muted and inflation being fairly sharp, it has restricted consumption to some extent. That is not the only reason why we have the kind of consumption impact as it were. Also, it has been recalibration of expenditure, as we said, because of calibration of loans and of real estate costs and education costs.

But I think this time around, it looks much more manageable because of the steps that the government has taken. One is, of course, the income tax relief on below 12 lakhs of rupees income that hopefully will start to play out in the current financial year. Some of it will go towards mitigating some of the loan repay commitments.

Some of it may go towards increased savings, but at least some part of it will come and which part of it, one can only speculate at this stage, will come in place for additional consumption. But the drop in the GST rates and the overall more benign nature or stature of inflation should hopefully be auguring better for economic growth than what it was in the past.

And if I were to now take you back, so let us say about 35 years, and if you were to look at the time you have spent with consumer products, including Nestle, in three brackets of maybe roughly 10 to 12 years each, how would you characterise what has changed with the Indian consumer in these phases?

Look, when I started my career going more than 40 years ago, it was almost a seller's market. Because in most categories, choices were limited. And if I look at soaps, they were very limited, detergents very limited.

In food products, they were very limited. It was also the licence raj in full blown impact on the economy, as a consequence of which the elasticities of demand were somewhat artificial. Because if you wanted to buy a soap and if the only soap available was a Lux or a Hama, you had to buy it.

I mean, you had no other option. Today, you have many more options. So, I think consumer choice and the varietal forms of consumption kind of opportunities that has been presented to the consumer is making for varied behaviours and sharp shifts in behaviours.

Earlier, there was a certain amount that used to be spent on essentials and it was spent because you had nothing else either to forego it or you had to spend it on whatever was available. I think over a period of time, now with the liberalisation taking place with greater choice coming in, people travelling more, getting exposed to newer consumption profiles, there has been a sharp change towards two or three things. One is the concept of value for money has become sharper.

The consumer is now more careful on value for money because he or she has a choice of many more brands. Number two is indulgences have now started to take place. Earlier, there was very few indulgences as far as consumer goods were concerned because the choices were limited.

And third Govind, I think one of the things which is probably going to propel the consumption economy forward is the sharp rise in premiumization. Whether it is a rural consumer or a semi-urban consumer or an urban consumer, their aspirations are now converging and there is availability and portfolio that has to be made available by companies and consumer markets. And I think that is the big opportunity that the country sees.

So really, it is a far more exciting era for both consumer connectivity, for consumer behaviour. The consumer has moved now completely digital. There was a time going in my early days when digital was non-existent.

So in the mid-90s and in the early part of the century, there was the rudiments of digital coming in. We used to have digital agencies coming and teaching us as to how to digitise communication. Today, digital kind of connectivity and digital resonance is an essential part of every marketing plan.

So there is nothing unique about it. In fact, companies have gone to the extent, I mean I can myself quote an example from Nestle, about 40-50% of our expenses for what we call advertising and sales promotion expenses, media related, goes towards digital media, which would have been hardly 5-10% a few years ago. So very sharp changes, but more exciting, more competitive and a greater bouquet of opportunities awaits the consumer.

And your successor also comes from the digital realm, so to speak, more than just digital, it's also e-commerce.

Yes, he also comes in with very strong credentials in that area. So it augurs well. So a consumer marketer with a strong background in e-commerce and digital marketing really helps to propel the company forward.

Right, let me take you back once again. So if you were to look at some of these themes, you said you joined Nestle in 1988. At that point, Nestle would have been roughly 75 years old already in India.

Now it's about more than 110 years old. And you had big brands in place, whether it's the Nescafe and I mean, I'm assuming Nescafe and Maggi. I mean, these are some of the big brands that have been there for now more than three decades.

So, and they were there before that as well. So what has changed in the brands and the way they connect with consumers and what's changed or rather what have these brands become by way of extensions and so on in this period?

You know, Govind, it's interesting to note that in its 100 plus years, 120 years of existence in India, Nestle has been, in fact, pioneers in many categories. We were the first to introduce sweetened condensed milk, the first to introduce instant coffee, the first to introduce wafer and roll chocolates, Kit Kat, the first to introduce baby food into the country, the first to introduce Maggi noodles, and then the whole noodle category. So there was a pioneering status in all of this, there was a first time for the country and for the consumer kind of experience that was put forward.

And therefore, I think the reason why the company remained strong in its competitive position in various categories is because of the first mover advantage that it took. And I think to that extent, consumers have grown with the brand. I mean, Maggi is now a 42-year-old brand.

People take it as me and my Maggi, whether you're 15 years old or 60 years old, it is your brand, it has become ubiquitous. And I think what we are privileged to have as a company is the ubiquitous nature of the brand and ubiquitous nature of the category and our association with it that builds for a strong reputation for the company as well. And I think that is really at the heart of the success of the Nestle company in India.

So if I were to ask the flip question, I mean, you know, so you have Maggi noodles, and you have Maggi ketchup, and of course, Nescafe, Neste, and you mentioned Kit Kat as well. So if these brands have remained roughly the same for, let's say, 30-40 years now, does it also suggest that consumers can also sort of be unchanging in their needs or desires?

You see, a very good question, Govind. You know, I would answer it in the following way. I think there are a set of core propositions that the consumer is unwilling to change on.

And there are innovations that the consumer is willing to experiment. So if I kept Maggi noodles exactly the same for the last 30 years, I would have been history by now. The core proposition of Maggi noodles, the masala or the pack graphics or the tonality or the occasion, that does not change.

Its manifestation in terms of execution changes over a period of time. So the flavours of Maggi are many more, the indulgences on Maggi are many more, the repertoire that the brand has built up is many more, but the core of the brand continues to be the same. It's the same with Kit Kat and Nescafe.

Nescafe is the instant coffee. It's the wake-up taste that people grow up with. It's now moved into a social drink of choice.

Again, it's got into the cold coffee realm, into the more indulgent coffee realm. All of these are different manifestations going with the times of the consumer, but the core proposition does not change. It's almost like a human being going.

Govindraj Ezderaj is fundamentally who he is. He can wear a new dress, he can take on a new avatar in terms of his accent or whatever else, but the core of Govindraj will remain exactly the same, the values and the purpose that he's nurtured with and that he manifests is exactly the same with brands as well. So we have to change with the times and now there is a double-click on change because now you've got competition that's both national and also regional.

There are some regional startup companies which are doing a great job, fantastic job of marketing and consumer resonance, and the big legacy players will have to ensure that they are up to speed in terms of being the brand of choice rather than also being an also that.

Let me ask you a little more about coffee. I mean, again, Nescafe, many, many decades old. Unlike maybe other categories, the big change in coffee consumption is obviously out of home coffee consumption.

We've had so many chains come in, local chains, global chains, and they continue to expand and grow even as we speak. How has that affected the consumption of Nescafe, the way it has been sold in powder form or other forms?

Actually, actually going very positively. You know, what has happened is every occasion for a trial is a potential occasion of a consumption of Nescafe. So out of home has really burgeoned and out of home, in fact, is the fastest growing business of Nestle India.

The growth has been phenomenal, double digit all the way through, even during the difficult times, it has done extremely well. How that is manifesting itself is that therefore the demand for Nescafe is increasing, because what you have out of home, you sometimes want to have it in home as well. So in home consumption has gone up.

You know, there was the time when tea was a drink of choice, tea is still 20 to 1 or 100 is to 1 in some geographies. But nevertheless, the social drink of the Gen Z and the youth is coffee. And it's also seen as a more premium form of camaraderie and friendship.

So with this escalating over a period of time, new coffee forms being introduced, I think it is going to augur very well for not only for Nescafe, but generally for the coffee business. I mean, you know very well, there are so many new roasters and new cafes that are opened up, all of which are doing well. And some of them are yet to turn in a rupee of profit, it takes time.

But nevertheless, I think they're making a dent on the consumer's mind and heart and stomach, which hopefully will benefit them in the long term.

And if you were to look at Nescafe, as a proposition, and the question that I'm coming to is really, internationally, you also sell Nespresso through capsules, and that's a big market. I mean, all in many parts of the world.

And you're only now bringing it to India. So I'm assuming that's because of the cost gap. But would it also, does that also mean that Nescafe, which I'm assuming is attacking the middle end of the market, is still a strong opportunity and therefore you're not looking beyond that?

Absolutely. One of the opportunities and the challenges for the Nestlé portfolio is that the level of penetration, which is loosely defined as the number of occasions the consumer chooses to buy during the course of the year. And even if you look at once a year, the levels of penetration, even for a brand like Maggi Noodles, is just about 75-80%.

If you ask them the question, do you buy twice a month or three times a month, the number clip drops to 20-30%. It's the same for coffee. The world of coffee consumption is still relatively minuscule.

So there is a wide runway that's open to all instant coffee companies to expand their repertoire in terms of penetration. But equally, the reason why Nespresso seeks resonance is because in premium consumption, that's the champagne of coffees. So therefore, when people want to have the best coffee and the best sourced coffee and the best tasting coffee and the most sophisticated coffee form, it is Nespresso.

So I don't think I'm saying that one day Nespresso will outsell Nescafe. Maybe that day will happen. But Nespresso will be a very good addition to the benefit platform of coffee in this country.

Let me come to Maggi. I mean, you talked about competition, and we've seen some very strong regional brands who also advertise locally and connect with consumers locally.

How would you say the response of a big brand like Maggi is or has been and rather will be when it comes to these kinds of trends? And let me supplement that. I mean, this sort of regional market response is also a newer thing.

And the question really is, are big companies or how effective are big companies geared to respond to these kind of challenges?

Look, I think the fact of the matter is, is that I have said this before, legacy companies cannot rest on their laurels of legacy. I think they have to make themselves constantly relevant to the new consumer. The Gen Z consumer or the Gen Alpha consumer today is a very irreverent consumer.

He or she doesn't care whether the brand was been around for the father's time or grandfather's time and great grandfather's time. It is I, me, myself and what satisfies me. And some of the new age brands are actually doing that.

Whether it is in terms of product form, whether it is in terms of communication, whether it's in terms of route to market, whether it is in terms of promotions, pricing, name it, they're all taking a different tack. So, companies like Nestle and many others will have to recalibrate their responses. As late as 10 years ago, when I took over as the head of Nestle India at a time of grave distress for the company, there were less than 10 other brands of noodles in the market.

At last count, there are close to 400 brands. So, the whole segment has exploded with a number of regional brands. And I think any marketeer who has the hubris to assume that these do not exist or these will not eat your breakfast, I think it's sadly mistaken.

And that's really keeping yourself relevant each day, each consumption moment, each hour, each year is the core task of marketeers, which makes it more exciting and which makes it also more challenging for companies.

And I'm going to come back to the A&M side of noodles in a moment. But before that, since you did mention the crisis that you faced and took over, which was really about Maggi noodles, what would be the one or two key lessons that you still retain from that phase when the product was banned and you had a lot of run-ins with government and so on?

Look, I think the one big important message that came out loud and clear is that the facts may be on your side, but is the perception also on your side? And perception is reality. So, we had done nothing wrong.

We went about initially harping on the technicalities and of the facts that were supporting us, little realising that it was a question of the stakeholders being deeply hurt and aggrieved by what had happened and making the perception into the reality rather than the facts into reality. And I think managing that deftly across the value chain and convincing the authorities and convincing the courts and convincing consumers that their beloved brand continues to remain what it was in terms of integrity and in terms of its promise was the big challenge. And in fact, I think one of the things that all companies, all captains of industry have to contend with is the fact that crisis does not come with a calling card and it can come any day and it can come and the leadership preparation is not an act of competence over courage.

It is a battle of courage that surpasses the competence in order to successfully deal with the crisis.

And you said that 10 brands at that time, it is almost 400 brands, but I know that you are, I mean, things came back to even keel and you have done better, but is there a number as to where Maggi went was before the crisis and where it reached after?

See, Maggi went from about 70 to 0 and came back to 60, but on a much larger base.

So, if I were to ask you, not to pin you down, but if I were to ask you in, let us say, in tonnes of or number of packets sold, what would the number have been then and what would it be today?

Well, the number today is probably close to 400,000 tonnes. The number was about less than half of that in 2015.

So, you are saying 400,000 tonnes of Maggi are sold every year by Nestle in India? Yeah. Okay.

So, let me come back to the advertising and marketing point that you mentioned and you said that, you know, Gen Alpha can be irreverent. I mean, they really focused on the here and now, they may not really care so much about brand promise, brand legacy and so on. How then do you advertise, I mean, not just right now, but even in the near future to this new cohort or new consuming audience?

You know, Govind, this is a simple fact. If you have to speak to your children, you have to understand the lingo and the framework of reference that they are looking at. I think the arrogance of doing what is called trial and tested models has to be jettisoned.

And in fact, real-time communication means real-time understanding of who your consumer is and what that consumer is seeking. So, constantly, the marketing team at Nestle and I guess at all other companies are mining consumer insights, listening to the consumer, looking at cross-category behaviours, looking at reactions to whether it is politics or economics or geopolitics or various other macro-level developments in order to distil a few truths that is representative of the category of consumers that they are referencing. So, it is a constant game, Govind, and I think it is a challenging game and the pot of gold is available to those who are able to painstakingly unpeel the and come to the truth of what the consumer is seeking. And the consumer is seeking something very different from what the consumer was seeking 20 years ago or 30 years ago.

Right. And I am just trying to understand. So, how do you, for example, calibrate your ad spend?

I mean, so much, which also links to my next question. I mean, so much of success is linked to distribution and is linked to, let us say, platforms like e-commerce. So, how do you calibrate?

I mean, this is more like a question that maybe a bunch of management students would ask you. I mean, how do you calibrate advertising and marketing expenditure and effort at a time when your feed is controlled by so many others?

Three or four factors come into play. One is the fabric of the category itself. What is the kind of core category behaviours?

Some categories are highly price sensitive, some others are less price sensitive. Number two is what is your market share position in them? Number three is what is your ambition?

What is it that you would like to know? There are two simple measures, a share of market and share of voice as they measure it. Sometimes you can live with a lower share of voice as compared to a share of market.

Sometimes you want to accelerate the share of voice in order to accelerate the share of market. So, the global objectives also are important. And last but not the least is the input-output ratio.

How much of investments are you going to give to generate? How much of incremental margin? More than turnover, how much of incremental margin?

And that should at least be a zero-sum game. If you spend 100 rupees, I at least get 100 rupees of margin at some point in time. It should not be that 100 rupees of expenditure is going to lead to 200 rupees of loss of margin and that is going to continue over a period of time.

So, multiple factors like this are used, a fair amount of modelling and sophistication is incorporated. And then ultimately, the judgement comes on how much should you spend and where all should you spend because there are algorithms that give you in which are the areas where the efficacy of spend is likely to be the best. The returns can be programmed.

And then of course, the management judgement calls saying, okay, I will follow something else in order to get to the objective that I want.

So, let me ask you about the role of instinct and intuition, including your own. I mean, again, through the decades, I mean, what's changed and what's not? And to what extent do you still trust and where are you applying it?

Look, I think there were two or three things that were happening in the past, which made decision making that much more vexatious and outcomes that much more uncertain. Number one was there was a paucity of data. We never had data analytics and frameworks to tell us it was all done on Excel spreadsheets or before that it was done on green sheets with pencil and paper.

So, therefore, it was a lot based on what I would say post facto information. You ran an activity, you ran a promotion, then you learned and then you implemented it the next time slightly differently. But today, you are able to simulate different scenarios and make them work for you and choose the one which is working the best for you.

So, that is one. Secondly, we used to have a philosophy of what I used to call spray and pray, which is spray the resources all across and hope that it sticks somewhere and gives you some results. That's how some brands have been built regionally and locally as well.

And the third one is that hierarchy became the decision making vector. So, the one who's highest on the food chain used to be given the decision making rights to decide on advertising, on communication, on strategy, on various other things, which really meant that sometimes data and information and insights never came to the table. But instead, a so-called senior man's gut became the preference point.

Now, I think today things are changing. Today, I think I can say that in my own tenure, I have been proven wrong many times that, you know, sir, you talked about this direction, but what the data is showing is something else. But ultimately, still, some of the core people process and partner related issues are based on experience and gut.

And no amount of data analytics can give you that insight that a meeting with a retailer or a distributor or a partner can give you in 10 minutes.

And what's an illustration of that, you know, from your own experience, where let's say you've looked at this mountain of data, and yet you felt that there was something not wrong, but you felt the answer lay elsewhere. And how did that manifest itself either in the...

Sometimes it happens on things like pricing, for example, and there'll be a modelling simulation that will say, take up the price by a rupee or take up the price by two rupees for a pack. And then there will be compelling reasons why you should take up two rupees, because of margin considerations, demand considerations, whatever. And then as a business head, I would take the call saying, oh, sorry, we won't do it now.

Because there are a few other external circumstances that is likely to impact the course of the business if you're not careful, and decide to not to take the decision that we were expected to take. That would be purely a gut instinct. It will purely be a judgemental call.

And it will be because of the hierarchy that one was in, that one was able to take the call. You do it seldom, you don't do it often. But nevertheless, I think it's an important part of the leadership job.

Last couple of questions. As you look ahead, and I'm sure a lot of young brand managers would want to ask you as to how to fashion their own approach to either creating a product or creating a concept and then a product and then distributing it in this new world of, let's say, e-commerce enabled distribution. And coupled with the period, I mean, coupled with the fact that the way you market is different, you know, I mean, the hits and misses are different. You may not be able to reach people the way you used to earlier.

We've also got the whole AI phenomenon that we have to grapple with and the way AI is redirecting traffic. So given all of this, how do you, I mean, what are the sort of first principles that brand managers or anyone who is studying this space should be thinking of or picking up from?

I think a few principles, what I've learned in my own career. First is a general principle, understand before being understood. I think today youngsters are in a tearing hurry to make an impact.

Impact does happen, but it's a little bit like a stork waiting for fish. It has to put its head under water at the right time. If it keeps on poking its head inside, nothing is going to happen.

So activity should not be taken for action. So understand before being understood, which is to understand your category and your brand completely in terms of all its manifestations. Number two is be the champion of the consumer within the company.

You are the consumer, you are not a marketer. If you design a product that you will yourself buy with a frequency of five on ten, it's not worth it. You have to design something which way you understand the consumer completely and fully.

Number three, remember you are there to make money. Sometimes we get very altruistic in our motives and saying no, no, no, it's for the general good of society. General good of society will never be generated by a company that decimates value.

History hasn't shown us that, which means that you have to have a path to profitability in what you do. And number four is that choose the place where the consumer wants your brand, when he or she wants it, and how he or she wants it. Don't have preconceived notions that there is only three channels that I have to use and this is the way things have to go.

And lastly, stay curious. I think one of the things that education tends to blind us to is an innate sense of curiosity, because we don't want to ask the embarrassing questions for fear of looking a little foolish. But sometimes you have to be able to ask the foolish questions, saying why does the consumer do what the consumer does?

There must be some good reason and simply because everybody in the organisation agrees to it, doesn't mean that is the whole truth. So these are a few of the things. And the last but not the least is I think actions speak louder than words.

More often than not, there are a lot of discussions take place on marketing flows, but seldom does it get translated into action, because of two things. One is less of a bias for action. And number two is a lack of courage, if things were to go wrong, because you can have a blowout in a marketing exercise that you do.

You should have the courage or your line manager or your leader should have the courage to stand up and be counted and say, look, the mistake is mine. I am the one who underwrote this particular experiment. But that doesn't mean that we have blown the bank.

We have learned something and we will move on to something else. So these will be the few lessons that I would share.

Mr. Narayanan, we have run out of time. Thank you so much. And it's been a pleasure speaking with you.

And I do hope to continue this conversation.

Thank you. Thank you for that. Thank you very much for the very inspiring conversations.

In this week's The Core Report: The Weekend Edition, Govindraj Ethiraj speaks to Suresh Narayanan, former chairman and managing director of Nestle on tax cuts, easing inflation, and shifting consumer priorities that may finally revive discretionary spending across middle India.

Zinal Dedhia is a special correspondent covering India’s aviation, logistics, shipping, and e-commerce sectors. She holds a master’s degree from Nottingham Trent University, UK. Outside the newsroom, she loves exploring new places and experimenting in the kitchen.