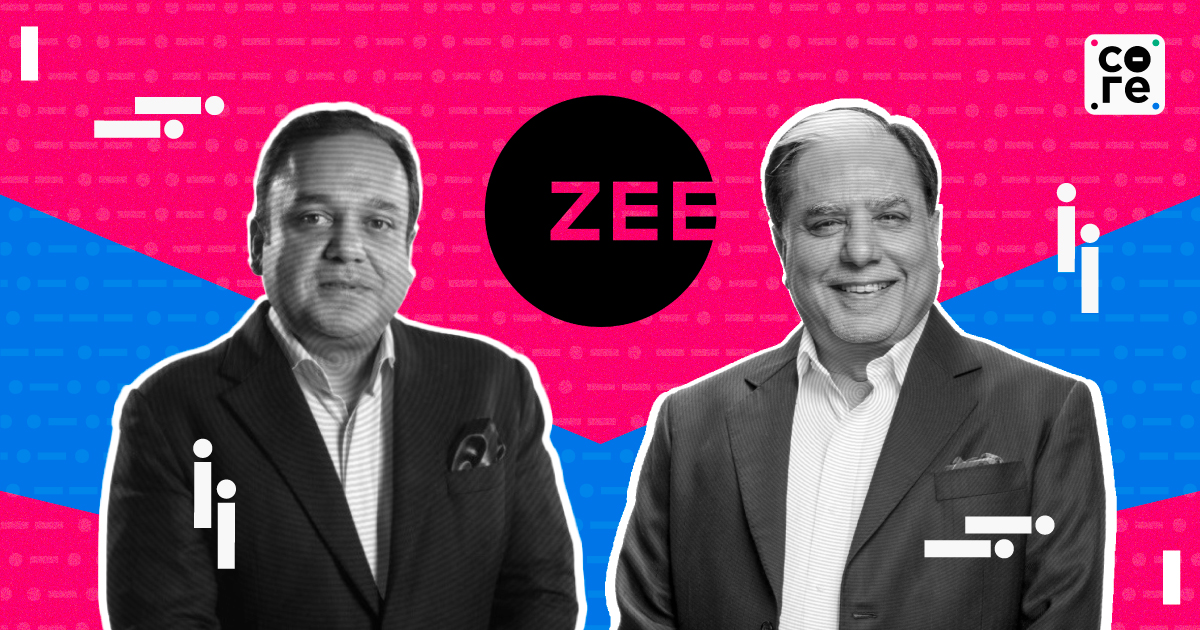

The Corporate Troubleshooter Leading Zee's Salvation

With the Sony merger blown, Zee is now looking to clean up its business and win back shareholders' trust. The promoters are relying on a veteran CA who is known for fixing corporate governance messes.

Media baron Subhash Chandra and his son Punit Goenka, CEO of Zee Entertainment, are living out the same storyline as their counterparts Shari Redstone at Paramount and Bob Iger at Disney. All three are juggling the urgent need to cut deals, identity leadership, wean off cash from the legacy business, and invest in long-term digital growth, all while assuaging nervous shareholders.

But the father-son duo have what Redstone and Iger don’t: the Forrest Gump of fixing Indian corporate messes.

Uttam Prakash Agarwal, 60, works out of an industrial estate located in Kandivali, a suburb in northwestern Mumbai. Employees and visitors of his chartered accountancy practice leave their shoes at the door. Part of the walls are lined with fat, leather-bound books on business, accounting, and Hindu scripture. The rest are adorned with awards, medals, and photographs of Agarwal with major political leaders—presidents, chief ministers, and prime ministers, both former and current.

Agarwal has been associated with the Bharatiya Janata Party (BJP) since 1988, where he first started as a treasurer of Ward 148 in Borivali, another northwestern Mumbai suburb. He has been a convenor of the Maharashtra Economic Cell of the BJP and a member of the party’s central finance committee. Yet the photos in his office have him with leaders across the ideological spectrum, from Prime Minister Narendra Modi, to his predecessor Manmohan Singh, to former chief ministers Lalu Prasad Yadav and Uddhav Thackeray.

His own ideological beliefs are rather straight and narrow, at least when it comes to business.

“Whatever companies have been made and destroyed, there was always a promoter’s vision behind it,” Agarwal told The Impression. “For your information, no industrialist who sells his home to set up a company sleeps well at night. Show me an industrialist today who goes to sleep without pills. It is the CEO, the CFOs, and the credit rating agencies who sleep well. Creating employment is the government’s job, but the industrialist does it instead.”

Agarwal is intimately familiar with the troubled Indian industrialist.

As the former president of the Institute of Chartered Accountants of India, he played a crucial role in the prosecution of Satyam auditors who were in charge when founder Ramalinga Raju cooked the company books. He was appointed an independent director on the boards of several troubled companies after its promoters faced financial trouble and/or criminal charges: Yes Bank, Reliance Capital, National Spot Exchange, and 3i Infotech.

Sometime late last year, Agarwal says he got a call from Zee founder-chairman Subhash Chandra. Would he, an expert manager of some of India’s biggest corporate governance mess-ups, be interested in helping out Zee Entertainment? “‘I am in the public domain. I have played an important role in Satyam, in NSEL [National Spot Exchange Limited]. People keep recommending my name [for independent director roles],” he says.

By mid-January, Agarwal had been appointed as independent director. Soon enough, he asked for a number of internal panels to look into all of Zee’s troubles, including a cost-cutting committee and an internal investigations team headed by a former Allahabad High Court judge.

Since its plans to merge with Sony fell through, Zee Entertainment has been in turmoil. ̛For two years, it was counting on the joint might of Zee and Sony’s TV broadcast, film, music, and digital businesses to turn things around. The Goenkas, with a mere 4% shareholding, are also struggling to regain shareholders’ trust.

But the headline is grim. In the last five years, Zee Entertainment’s revenue from operations has grown just under 2% in total, while its net profit margin has dropped from 19% in FY19 to 3% in FY23, per its latest annual report (pdf). In the first three quarters of FY24, income from operations is up over 10% but net profit margin is down to 3.5% from 9% the year before (pdf). In 2024 so far, the company has lost more than half its market cap.

Zee Entertainment declined to comment, citing the regulatory ‘silent period’ before it reports earnings for the March 2024 quarter and FY24.

Rock And A Hard Place

Zee has set an aggressive profitability target for itself: Ebitda of 18% by FY26. Note: Zee’s Ebitda margin for the first nine months of FY24 was just shy of 11% (pdf). Delivering it is more likely to convince the markets that Goenka is the right man for the job. Two senior executives told The Impression the general belief in the firm is that there is no viable alternative for the top job, especially because a turnaround plan is already in motion with the blessings of the board. They spoke on the condition of anonymity. It all comes down to whether Zee can deliver on this promise. Most of it will come from deep cost cuts in the short-term.

But the short-term promise comes at the cost of long-term growth. The world’s biggest media companies are busy weaning themselves off of their traditional cash cows — particularly TV — as they ramp up investments in digital and turn streaming profitable. Disney sold its TV channels in Asia (including Star India), Warner Bros. Discovery is struggling with anaemic TV ad revenue, and cable-heavy Paramount is struggling to find a buyer, all while Netflix, which has cracked long-term digital profits, clearly says it isn’t interested in buying TV.

Last fiscal, Zee spent just over Rs 600 crore on a technology and innovation centre in Bengaluru, largely on top talent and R&D (research and development). That centre has now been gutted. “The centre was built to fix the core of Zee’s tech stack,” one of the two senior executives quoted above told The Impression. “The idea was to move from the inefficiencies of working with so many external vendors and build a strong technology core for the firm. Besides, Sony was about to come into Zee; the technology system was designed to manage a much bigger digital business.”

Acquisitions like SugarBox, a startup that provides local WiFi, would help Zee strengthen key technology functions such as content delivery, which is especially important in live streaming. Eventually, Zee had hoped the tech centre could generate revenue on its own, selling its proprietary technology to other customers.

In the last few years, no other major Indian broadcaster has invested this much money to set up a separate technology and investment centre in the manner of Zee. Some, such as Star India, bought stakes in tech startups in the 2010s. But there is greater urgency today to invest in good quality technology as traditional broadcasters move to streaming. Just last month, Warner Bros. Discovery introduced its own first-party data platform for marketers. Earlier this year, Disney launched an AI advertising tool called ‘Disney’s Magic Words’.

Without a slate or a dedicated executive heading Zee5, growth from streaming isn’t an immediate priority either. Zee’s shareholders were expecting to be owners of a credible large media empire that can take on the Reliance-Star-Disney combine. Will they settle for a shrunken business relying on past growth engines, just for a bump in Ebitda (earnings before interest, taxes, depreciation and amortisation)?

Agarwal declined to comment on the goings-on within Zee Entertainment’s board, citing protocol, but he believes the company’s primary problem isn’t corporate governance. Subhash Chandra and his sons Punit and Amit are under investigation in various cases of financial irregularities, chiefly in allegations of misappropriation of Yes Bank deposits and investments in Shirpur Gold Refinery.

At the heart of Yes Bank’s funds misappropriation case is a Letter of Comfort from September 2018, personally provided by Subhash Chandra, to adjust an outstanding loan worth Rs 200 crore for a fixed deposit that he later allegedly misappropriated. Incidentally, Agarwal’s path had already crossed with Zee’s future troubles, which he is now fixing. He was appointed to Yes Bank’s board of directors just two months later, in November 2018.

“I haven’t seen any corporate governance issues in Zee in the last 3-4 months that I have been an independent director,” Agarwal says. “Also, I don’t foresee that a person like Subhash Chandra will make mistakes. He is a very sensible person and won’t do anything wrong.”

Yet, there are reports that Chandra has been taking crucial business decisions at the firm. One former senior executive told The Impression that he was attending board meetings and taking layoff decisions. They spoke on the condition of anonymity.

Agarwal denies this.

“Subhash Chandra has never attended a board meeting,” he says. “He has never interacted with any board member officially, never talked to us regarding any board meetings. I can give you this in writing in a board letter.”

Yet, Agarwal says, Chandra has a right to advise the company informally. “As Chairman Emeritus, he is permitted to be in the office and to offer his advice as a veteran of the media business. We [the board] had just one meeting where we informally asked him about the business.”

That is a bit of a grey area. India’s Companies Act does not recognise the position of Chairman Emeritus. “This is a tricky one. This is an honorary position, given to someone as a token of recognition,” an independent corporate governance expert told The Impression on condition of anonymity. “There are no legal specifications of what a company must and must not share with a person holding this position. Shareholders are asked for approval on their salaries, but not on the decision to appoint someone to this position. The risk with having a Chairperson Emeritus in company matters is that it muddies the waters with regard to chain of command. Yet, veteran business builders often have invaluable skills and contacts that a company will benefit from. As long as those skills are still relevant.”

The question to ask the Zee Entertainment board and Subhash Chandra is whether he is involved in day-to-day operations, or simply asked for an opinion on strategic decisions. Agarwal maintains it is the latter. “But this can be difficult to do,” says the corporate governance expert quoted above. “We are on the outside looking in. Yet, to say that a company veteran should simply be put out to pasture and not allowed into the office isn’t right.”

The board is pushing full steam ahead on a cost-cutting exercise, with CEO Punit Goenka in charge willing to be guided on the best way forward, Agarwal says.

Zee’s bleeding films business first prompted the board to take a hard look at the company’s costs, Agarwal told The Impression. “We [the board] were told that even in FY25, the films business will post a loss,” he said. “Only one or two films were making money for the company. Then why are we assigning all this manpower and Rs 300 crore when you will make losses even this fiscal? That is when we decided that we have to start showing a profit from somewhere.”

In March, the company slashed its workforce by 50% in its Bengaluru tech and innovation centre. A week later, it cut 15% of all jobs across the company. Digital investments in the Bengaluru tech centre and Zee5 were given free reign and plenty of talent by Punit Goenka, the two senior executives quoted above told The Impression. “PG may not always have a clear idea of how, but he was always very clear about investing in future growth and gave executives the freedom to execute it,” one of the executives said.

Besides, Zee has made sweeping changes in its top leadership, letting go of top executives including content head Punit Misra and revenue head Rahul Johri. Both executives were appointed to the senior roles in 2020 to spruce up Zee’s financial performance and make the company more process-driven, especially in subjective tasks such as commissioning and acquiring content, according to the senior executive quoted above. Another insider close to the company told The Impression that Punit Goenka handpicked Johri, formerly the CEO of the Board of Control for Cricket in India, to push Zee to higher profits. Misra and Johri handled content and revenue across all Zee verticals, something that the company was new to.

Now, another member of the family — Amit Goenka — has taken charge of all content while executives managing revenue in the broadcast business are directly reporting to Punit Goenka.

Zee is also holding off from making original content for its OTT platform Zee5, two industry executives aware of the development told The Impression on condition of anonymity. While competitors Netflix and Amazon Prime have unveiled vast slates of original films and shows in India for the year, Zee5 is only releasing what has already been made. Besides, Nimisha Pandey, Zee5’s head of Hindi originals, has quit the firm.

Sympathy Pains

One would take such sweeping reorganisation and deep cost-cutting as a sign that the company had been careless with its past investments, both in content and in talent.

Yet, Agarwal maintains, Zee’s promoters are being targeted unfairly. “An industrialist is not so intelligent,” Agarwal says. “He hires professionals to help him execute his vision. Why do they not object when they see something going wrong? It is their job to do so.” He cites the example of Yes Bank founder Rana Kapoor, who was jailed in 2020 for an alleged Rs 466.51 crore bank fraud, pointing out that no one in the management was ever accused of being complicit in the crime.

“Rana Kapoor went to jail for four years. Yes, he made a mistake, but nothing different from what ordinary politicians and bureaucrats do. He gave jobs to 28,000 people. He used to call me up at 3 am on some nights to check if a decision he was about to make was appropriate, although I would remind him I’m merely an independent director.”

Agarwal eventually quit Yes Bank’s board in January 2020, alleging corporate governance failure under Ravneet Gill, the banking professional who replaced Kapoor in early 2019.

Clearly, the board and its prominent corporate governance clean-up man have reposed their faith in Subhash Chandra. That may not be enough to assuage shareholders. Remember, in January this year, key minority shareholders discussed calling an extraordinary general meeting to oust Goenka as Zee’s chief executive. Three years ago, key institutional investor Invesco had attempted something similar before exiting the company last year.

For the people at the top, particularly turnaround specialist Uttamji, the priority is saving a hard-working industrialist’s homegrown media empire.

“I was so happy when the merger [of Zee with Sony] did not happen,” Agarwal says. “I was happy that an Indian company was saved. If we don’t support them [Indian entrepreneurs], we will be sold off… foreign companies come and take away our talent, our resources. Netflix, Amazon, Sony are all foreign. What Indian company is left?”

With the Sony merger blown, Zee is now looking to clean up its business and win back shareholders' trust. The promoters are relying on a veteran CA who is known for fixing corporate governance messes.

Soumya Gupta is a media reporter with 10 years of experience. She has previously covered consumer, retail, and e-commerce businesses at The CapTable, The Economic Times, Mintt, Fortune India, and Bloomberg.