Indian EV Owners Are Forced To Download Hundreds Of Apps: Here's Why

India's EV users are getting increasingly overwhelmed by the number of apps that they have to navigate to charge their vehicles and addressing this pain point is key for larger EV adoption

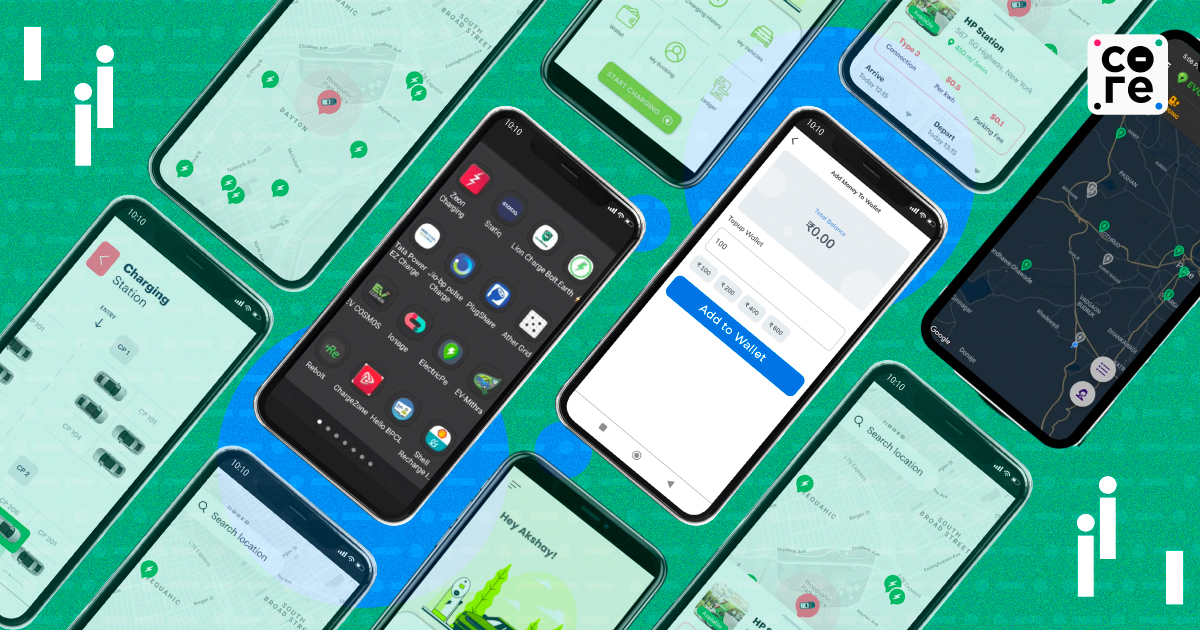

Bangalore-based electric vehicle (EV) owner Chintan has a Tata Nexon EV and a TVS iQube scooter. For these two vehicles, he also has 112 charging apps on his phone. “Whenever I go to a new city or say if I'm travelling, every [public charging] station that I go to, I’ll find a new app that I'll have to download,” he told The Core.

Of the over 100 apps that he has downloaded in the course of his long-distance travels over the last three years, Chintan uses about 20-25 apps regularly. For him, payments through these apps are the biggest hassle, since most EV charging apps have wallets that need to be recharged with a minimum balance before they can be used.

For Delhi-based Priyans Murarka, who also does several long-distance trips in his MG ZS EV and runs a blog on electric vehicle (EV) experiences, the lack of interoperability becomes a problem when planning a trip.

First, an app is needed to find chargers on the route, and like most EV users globally, he uses the PlugShare app. Then he needs other apps to find out if the chargers are functional. “If I have to look at the Bombay-Delhi route [and] I see that there are two Chargezone and two Tata Power chargers, where I want to charge. Now on each app, I have to go and see whether they're live or not. If there is a single app, which at least shows the real-time status, then that would be great,” he told The Core.

Coimbatore-based Arun, who owns an Ather 450X and has done several cross-country trips with it, said he has downloaded multiple apps just to check the status of the chargers. But he barely used any of them to charge. “Ninety-five percent of the time on road trips I just slow charge, using my plug,” he said. This, he said, was mainly because chargers aren’t often reliable, and he doesn’t want to unnecessarily recharge the wallets.

According to a 2021 study, Indians have, on average, 48 apps on their phones. But if they’re an EV owner, one would tack on at least five to 10 apps only for their public charging needs.

What do EV users need these apps for? First, to locate a public charger in their surroundings that fits their needs. But that’s not all. They also need an app to find out if the charger they have spotted is working or not, so they don’t waste a trip. Then the app is needed to book or reserve a slot, to actually charge and make the payment, often via app-based wallets that need to be topped up before booking a slot.

There are currently over 50 charging point operators (CPOs) in the country, and most of them have their own apps. To charge at a particular CPO, one needs to download that app and fill up the wallet with a minimum amount (in most cases Rs 100) before charging. Most manufacturers have their own apps with dashboards showing chargers that are accessible to the vehicle as well.

A, another MG ZS EV owner based in Mumbai, uses the vehicle for their daily commute to work. “There is a charging point in my office building and otherwise I slow charge at home,” they told The Core. A uses EV apps to locate public chargers nearby, but only as a backup.

A solution to the problem of payments and the need to download so many apps would be a master app, a go-to for all of the needs of an EV user, but several barriers are stopping India from getting one.

Why The App Fatigue?

The Core had reported earlier how home charging is currently preferred by a majority of EV users because it is simply more convenient. While the government has been pushing for wider adoption of EVs, and Indians have been buying more EVs than ever before, public charging infrastructure has been lagging.

“If you are going to be stationary in a city, you’ll have zeroed down on a particular CPO’s charger, you will want to keep going there, because you know that that charger works,” said Murarka. “You figure out what charger works for you, and then you stick to it. So not that big of a problem. But the multiplicity leaves people confused,” he added.

With so many apps to navigate for one task, it is overwhelming and daunting. Addressing this pain point is key for larger EV adoption and an aggregated platform or a master app would be the answer. In June last year, the government announced that an app developed by the NITI Aayog would be launched soon, but the plan hit roadblocks soon due to pushback from industry stakeholders.

CPOs were reluctant to be on a master app because they didn’t want to share user data and lose their competitive edge.

/thecore/media/media_files/YGnnGBF0USwBHFlnGssO.jpg)

Payments A Major Block

Wallets are another problem. Some CPOs have moved to a QR code-based system of payment, but most apps still have a ‘closed-loop wallet’ system. A closed-loop wallet payment means that you can load money into a spending account and use it for that particular brand or company only, as opposed to an open loop which allows users to pay for multiple businesses using the same wallet (like Paytm). This closed-loop wallet is a major deterrent for users to use these charging points.

“If I'm going for a long ride, relying on 10 different apps, I have to pay a total of Rs 1,000 [to fill up the wallets]. To be honest, I'm going to use around Rs 300-400 only, the rest will be lost for no reason,” Arun pointed out.

Chintan added that after a bad experience with an EV rental firm – where he had recharged his wallet in the app before the company shut down and he can’t access the wallet anymore – he is more wary. “Now I'm worried about what will happen if some charging operator just goes away...it’ll be a long process to get that money back,” he said.

/thecore/media/media_files/Ww2PVxkQRBenpF80uinx.jpg)

Another example of an extensively used closed-loop payment option is the Starbucks wallet. But because in the US there is a Starbucks store every 15 minutes, it makes sense for users to put money in their wallet, which isn’t the case with EV charging apps in India.

The probability of an EV charging station being around is not anywhere near as high. But CPOs prefer to use these wallets because they are recognised revenue even if the customer does not charge.

“The question is, with how much ease can a customer accept this new technology, without creating any friction?” Nitish Arora, electric mobility lead at Natural Resources Defense Council (NRDC) India, and former deputy research head at Ola Electric Mobility, pointed out. “What we always forget while asking customers to adopt any new technology is that first we need to delight the customer… and to create that delight, you need to understand what are the pain points of the customer journey for a particular EV charging station,” he added.

Need For Aggregated Platforms

When the first iterations of the EV charging apps came out as the FAME-I (2015-2019) policy was implemented, not enough user research was done. “Because again, there weren't enough EV users in the market to go do user research,” said Akhil JP, co-founder of Pulse Energy, a third-party EV charging app and API platform. Then, as the industry scaled up everyone had the same cookie-cutter approach.

“This is where we came in,” he said. Pulse Energy started in 2019 intending to solve this problem of multiple apps for individual or retail users. But they soon realised there were very few retail takers. Because individual vehicle owners are not charging at public charging stations very frequently. Second, the reluctance to pre-pay a subscription fee or a minimum wallet balance kept many away. “At the end of the day, for us, we make money when they actually transact.” Most users The Core spoke to said that they downloaded several apps but would not use them until they absolutely needed to.

“There is no financial incentive for a company to solve that problem,” Akhil said. Soon after, the company found a more captive market in fleet operators, where drivers’ charging needs are daily and there is a need for an app or an API platform, both of which the company offers. A majority of the company’s revenue is now driven by its business with fleet operators – the company has roughly 14-15,000 fleet drivers using their platform daily, while individual users maybe not more than 3,000-4,000.

The Data Wars

A key barrier to the formation of a master app is the unwillingness of CPOs to share data. EV chargers generate a lot of data – on energy consumption, billing and payments, and essentially, user behaviour. For example, if a charging point in a particular spot is extremely popular with a certain segment of users, the CPO would not want its competitors to be aware of this information.

“Here, the data is the currency,” Arora said.

Stakeholders pushed back against having to share this data with third parties and with other CPOs for fear of losing out to market competitors. Not just this, many CPOs and other stakeholders want to hold on to the edge they have – for some, it could be a superior product that they have designed with better user experience, or that they can customise lucrative offers for their users.

The Solutions

In 2023, Akhil and his team also released an adaptation of the Beckn Protocol for energy transactions – a sort of “ONDC for energy transactions” – called unified energy interface (UEI) protocol. While it is already running, it needs government backing before it can be deployed, he said.

“You need a government body to look at UEI and say, ‘this is going to work, I’m going to back this up and build it for the country,” he said, adding that if a private for-profit company pushes it, the industry will be wary.

Arora echoed the same sentiment. Without a government push, private players have no incentive to streamline or aggregate the charging process. “There is more work to be done by the government on this…And state nodal agencies for EV charging must build on CPO accountability,” he said.

NITI Aayog’s master app was set to aggregate all charging points on one platform, where users can locate them, book slots and pay via an in-built e-wallet. The progress on this has completely stalled now.

Some leading CPOs in the country have already moved away from the closed-loop wallet system to either QR-code-generated payment systems or tying up with third-party wallets like Paytm.

This is not just an India problem. Regulations were put in place in Europe last year, mandating that customers must be able to make card or other contactless payments. In the UK as well, operators are required to allow customers to make card payments or use third-party payment platforms for charging.

At the end of the day, an aggregated platform or a streamlined process will only benefit CPOs. “Because it enhances the value proposition for customers to switch to EVs…and if there are more customers who are now switching to EVs, there are more vehicles on the road, which ultimately brings them more business,” Arora said.

India's EV users are getting increasingly overwhelmed by the number of apps that they have to navigate to charge their vehicles and addressing this pain point is key for larger EV adoption

Jessica Jani is a producer and writer at The Core where she covers mobility, sustainability and energy transition. She is based in Mumbai.