The Unopened GST Diwali Hamper Creates Hurdles For The Season Of Discounting

To discount or not to discount — that’s the question chasing retailers this festive season.

The Gist

Retailers were anticipating inventory clearance through discounts before the GST slab reduction, but the government's delay in details has disrupted these plans.

- Dealers previously offered significant discounts on older auto models amid declining sales.

- Experts warn that if GST benefits aren't fully passed to consumers, the intended positive impact may not materialize.

- Retailers face challenges with excess inventory and potential revenue hits, complicating the festive sales season.

Weeks before Prime Minister Narendra Modi collapsed the four Goods and Services Tax (GST) slabs into two, many retailers were hoping to offload piled-up inventory through discounts. The government’s promise of GST rationalisation with details that are expected to come around Diwali — a rollout only in September — has put these plans in disarray.

Take autos, for example. Dealers were offering discounts of Rs 40,000 to Rs 1 lakh on older passenger vehicles models to move inventory, before the announcement. This was especially after July auto sales fell by 4.3%, as per FADA (Federation of Automobile Dealers Associations). Now, of course, most analysts are questioning the quantum of discounting.

Ideally, the GST reduction benefits have to be passed on to the customer. Yet, there is more haze than clarity without the final brass tacks. At the very least, some of these originally intended discounts could also be rolled back — even as inventory for slow-moving models accumulates with dealers.

“The GST rate rationalisation exercise is likely to be successful only if the rate cut is passed on entirely to consumers. If original equipment manufacturer...

Weeks before Prime Minister Narendra Modi collapsed the four Goods and Services Tax (GST) slabs into two, many retailers were hoping to offload piled-up inventory through discounts. The government’s promise of GST rationalisation with details that are expected to come around Diwali — a rollout only in September — has put these plans in disarray.

Take autos, for example. Dealers were offering discounts of Rs 40,000 to Rs 1 lakh on older passenger vehicles models to move inventory, before the announcement. This was especially after July auto sales fell by 4.3%, as per FADA (Federation of Automobile Dealers Associations). Now, of course, most analysts are questioning the quantum of discounting.

Ideally, the GST reduction benefits have to be passed on to the customer. Yet, there is more haze than clarity without the final brass tacks. At the very least, some of these originally intended discounts could also be rolled back — even as inventory for slow-moving models accumulates with dealers.

“The GST rate rationalisation exercise is likely to be successful only if the rate cut is passed on entirely to consumers. If original equipment manufacturers (OEMs) look to absorb part of this benefit in the form of a reduction of discounts, etc., then the full benefit of this move will not be visible. Hence, it remains to be seen whether the government reinstates the anti-profiteering mandate, that has already expired, post the proposed GST rate cut,” said Motilal Oswal in a recent report.

Still, experts warn that GST will not cure the demand slump. The post-Covid sales rush was an unusual demand peak — that has long since gone off steam.

“Pent up pandemic demand is surely over. Revival will take another 12-15 months as we are not seeing consumer capital purchase cycles reviving yet. Auto is a high-value purchase and revival is tightly correlated with economic growth,” said Madhur Singhal, managing partner, consumer and internet at Praxis Global Alliance.

Who Moved My Cheese?

The sales season has already been truncated, as people wait and watch for the final details of GST reform. India’s festival sales season kicks off in the first week of August with Raksha Bandhan, traverses through Ganesh Chathurthi later the same month, peaks during Dusshera and Diwali, which fall anywhere between late September and early October and ends with the grand finale in December — the winter months bring more cheer as it juxtaposes with the wedding season as well.

Retailers across sectors are now holding on to goods, messing with the supply chain. White goods, especially fans and ACs, have had a particularly bad run this summer because of the early onset of the monsoon. They’ve had a double whammy as companies like Voltas, Havells have undertaken ‘robust channel stocking’ after last year’s heatwave.

ACs, along with TVs, are expected to move from a 28% GST slab to 18% — which could land a good deal for consumers — on the face of it. In reality, however, the stressed channel stocking could change the dynamics of discounts in multiple ways.

“This issue is even more challenging for retailers and dealers. With many already holding higher-than-average inventory, which was purchased at the prevailing, higher GST rates, any delay in consumer purchases would result in a direct revenue hit. To avoid this, dealers may need to offer deeper discounts during the festive season to clear their existing stock, or, depending on market conditions, choose not to pass on the full benefit of the tax cuts to consumers later,” said a report by Ambit Capital.

What Meets The Eye

The government, which has long since been battling between essentials and luxury goods, have recognised aspirational goods. They include refrigerators, along with TVs and ACs, which have now become necessities for the evolving middle class. But will the GST slab cut have a real impact on the price tags?

How much have companies passed on to consumers might be a question that will keep coming up. Categories like white goods and cars explicitly disclose the GST, so the price and the discounts can be checked, and the GST component might be more transparent. With categories like apparel, things might get a tad tricky.

“In FMCG or apparel, the MRP (maximum retail price) embeds the GST. Moreover, FMCG and apparel price changes are not easily perceptible as discounts, bundles, bulk pack pricing changes. Some categories work on specific price points and that further leads to price drops not passing through,” warned Singhal.

A few sectors have been burdened with the many GST slabs that do not add to their cost and input prices. For example, in the inverted pyramid structure of GST, companies pay a higher GST for their raw material, while their finished product falls under a lower slab.

“Retailers Association of India (RAI) urges the government to ensure that the new structure does not lead to inverted duty structures in certain product categories. We also recommend that the tax rate on a single product should be standardised at one GST rate across all price points, regardless of the value per piece,” said Kumar Rajagopalan, CEO of Retailers Association of India (RAI).

E-Commerce Holds On To Hope

While dealers in general have been fretting with inventory, the discount-driven e-commerce is hopeful of a bumper season. Online platforms’ festive season peaked in 2021, but GST might be a game-changer, experts hope.

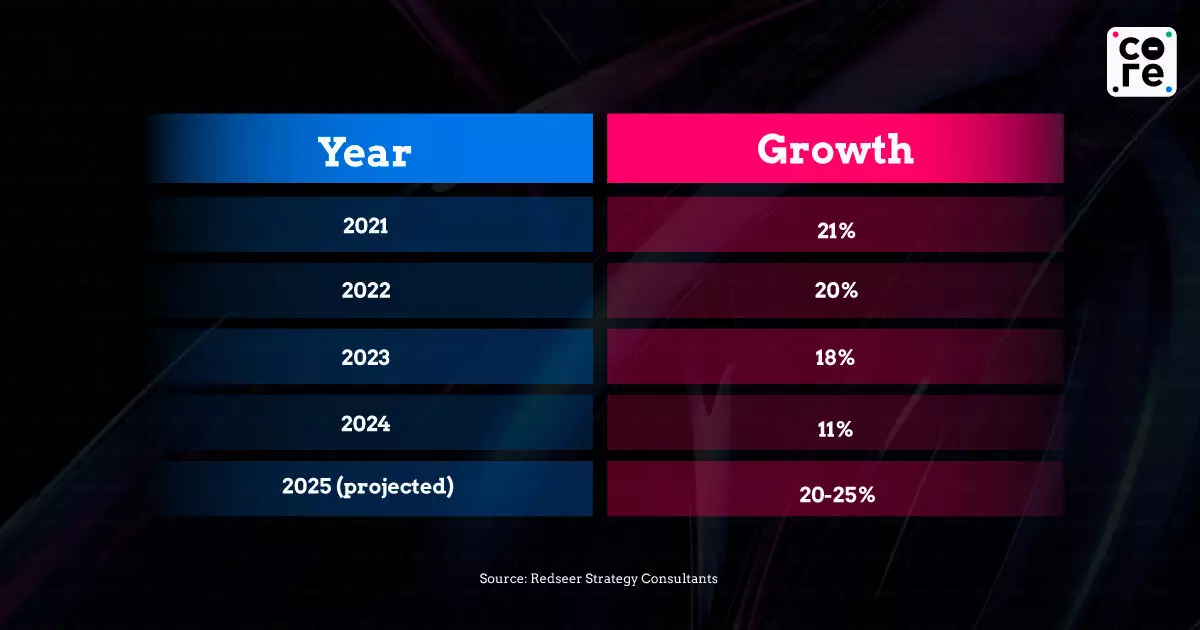

“A mix of macro tailwinds— repo rate cuts, higher disposable income limits, rural affluence, and pent-up demand across appliances, fashion, and home categories, will supercharge consumption. E-commerce will lead the charge, expected to grow 20–25% YoY this festive season (~2x last year’s pace), generating over Rs 1.15 lakh crore GMV (gross merchandise value),” says Redseer Consultants.

However, pushing sales after the GST announcement might alter the pre-Diwali sales – especially Flipkart’s Big Billion Days sale, Amazon’s Great Indian Festive sale. “With GST simplification potentially shifting some big-ticket purchases post-Diwali, brands must prepare for two demand waves: festive and year-end,” the Redseer report adds.

All in all, this festival season, dealers deal with deeper discounts, and companies devise ways to absorb some of the gain, while consumers hope to get the long end of the stick.

To discount or not to discount — that’s the question chasing retailers this festive season.