Insurance Sector Won’t See The Death Of The Salesman Anytime Soon

A brick-and-mortar approach with agents and a human touch is still needed to sell trust with life insurance.

The Indian insurance industry is making rapid digital strides — from piloting artificial intelligence (AI) processes that detect a smoker via video to settling death claims without consumers walking into an office, and much more.

Yet, when it comes to selling an insurance policy to a person, it’s a human being that seems to be doing a better job, explained Mahesh Balasubramaniam, managing director of Kotak Mahindra Life Insurance Company.

Kotak Life, which has end-to-end digital processes such as AI-led hyper-personalisation for customers and agency tools, is still doubling down on physical branches. It plans to add 70 more branches by the end of the year to hit a target of 400.

“I don't think we are at a stage where all our products are consumed completely digitally. Secondly, our business model, especially in life insurance, is still phygital when it comes to selling, right?” says Balasubramaniam.

‘Insurance is sold, not bought’

A few ‘simple’ insurance products like motor or two-wheeler insurance have migrated to an end-to-end digital model, but life insurance products need a human touch.

“A pure term policy can still be sold digitally. Whereas our investment products, whether it is ULIPs or traditional plans, require an advisory approach where we are engaged with the customer by physically meeting the customer and giving them solid financia...

The Indian insurance industry is making rapid digital strides — from piloting artificial intelligence (AI) processes that detect a smoker via video to settling death claims without consumers walking into an office, and much more.

Yet, when it comes to selling an insurance policy to a person, it’s a human being that seems to be doing a better job, explained Mahesh Balasubramaniam, managing director of Kotak Mahindra Life Insurance Company.

Kotak Life, which has end-to-end digital processes such as AI-led hyper-personalisation for customers and agency tools, is still doubling down on physical branches. It plans to add 70 more branches by the end of the year to hit a target of 400.

“I don't think we are at a stage where all our products are consumed completely digitally. Secondly, our business model, especially in life insurance, is still phygital when it comes to selling, right?” says Balasubramaniam.

‘Insurance is sold, not bought’

A few ‘simple’ insurance products like motor or two-wheeler insurance have migrated to an end-to-end digital model, but life insurance products need a human touch.

“A pure term policy can still be sold digitally. Whereas our investment products, whether it is ULIPs or traditional plans, require an advisory approach where we are engaged with the customer by physically meeting the customer and giving them solid financial advice. It means a lot of agents have to be on the field to go and talk to customers,” added Balasubramaniam.

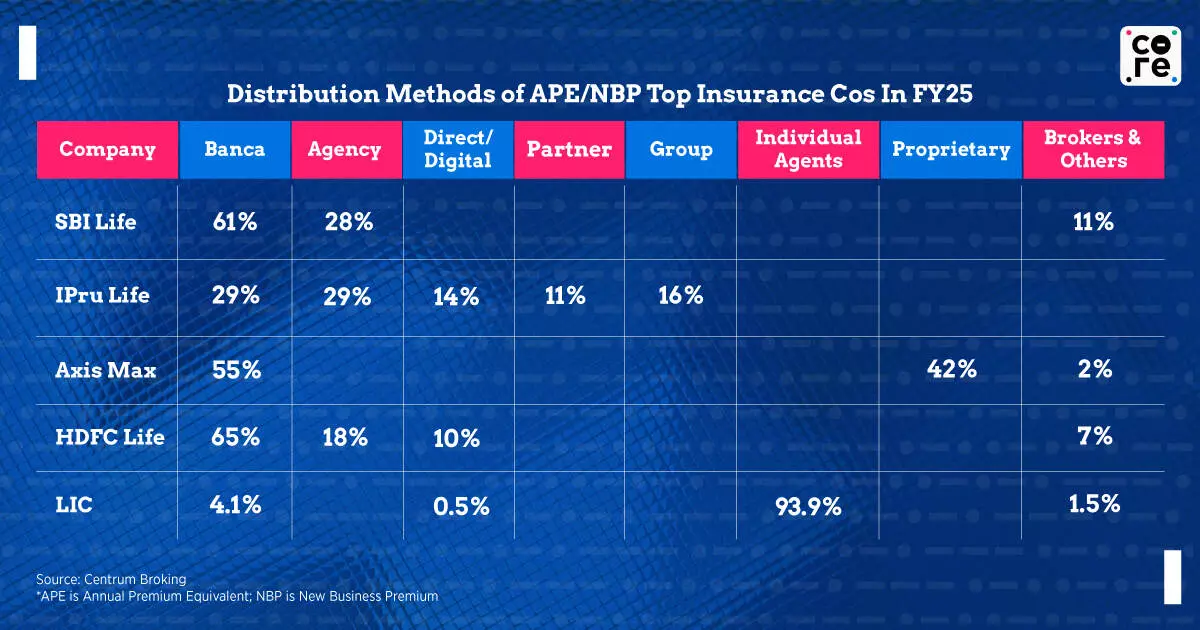

As evidenced below, most of the insurance sales come from bancassurance, or agencies for top private companies, with very low contribution from direct or digital sales.

Pure digital sales are still in lower single digits for most companies, said experts. LIC, however, sells most of its life insurance via agents.

Payments, renewals, and processing, however, are very much digital. In most cases, customer onboarding is done paperlessly with as few documents as possible, say life insurance companies. However, they need the physical outlets to office the sales agents to bring in new business.

“The digital insurance model by D2C end-to-end digital is hardly 3-4% of the life insurance industry. A large part of the business comes from bancassurance, a large part from agency and direct marketing. All this requires a physical interface, as my agents need to come to the branches to get trained. My employees sit in my branches,” said Balasubramanian.

Sector experts also said that long-lifecycle product purchases like life insurance are not merely transactional. “The products need explanation, hand-holding with research. Human agents are needed for the high emotional intensity to sell the processing. While misselling does happen due to the same reason, buyers need the validation of a human. A digital channel cannot build that trust,” said Abhishek Kumar, founder & chief investment advisor of SahajMoney.

As the head of liability of a top insurance company simply puts it, “Insurance is a sold product, not a bought product.”

Insurance Products Get Complicated

Life insurance has become increasingly complex and layered over time, with a growing number of products entering the market every year. A simple life insurance product involves paying a premium, providing comfort that, in the event of their death, dependents would be taken care of.

Yet, most humans are happy to simply stay alive, and expect something back for all the premiums that they have paid for, and not enjoyed on account of their extended life. Specific products have been created for such customers, such as return of premium products.

For those who do not want to pay for the entire coverage time and want to pay only for ten years, there is a limited premium product with a tenure of 30 years.

A few others want capital guaranteed products, who want to invest in markets but need their capital back. Another plan is a combination of a traditional plan and a unit-linked insurance plan (ULIP) with a blended combination of a capital guaranteed product.

“Depending on the lifestyle, depending on the risk of the consumer, I think various products have been evolving. For instance, in the retirement space, a lot of work is happening now. We all have something called deferred annuity. We have products called TULIPs, which are a combination of ULIP and term plans,” said Balasubramaniam.

Matching the right product with the right customer depends upon the stage of the career as well as the personal goals of the buyer. On top of it is the economic dispensation of the consumer, which classifies life insurance plans yet again into mass, mass affluent, affluent and HNIs. They are also made for different types, such as salaried employees, self-employed individuals, retirees, as well as homemakers.

“The third element which comes in the life insurance industry is the age of the customer. If I look all this into a three-by-three kind of a cuboidal structure, our products are all designed to make sure that it addresses the lifestyle requirement of a customer, the age the customer is in,” explains Balasubramaniam.

More and more niches are being added to the insurance products — be it PAR products that help consumers ride the interest rate wave, or Gen2Gen Protect plans for children as well. The rising complications also make it imperative for informed, educated, motivated, as well as salesmanship, of humans.

A brick-and-mortar approach with agents and a human touch is still needed to sell trust with life insurance.