Cable TV’s Digital Disruption: A Jugaad Industry Is Meeting Its Comeuppance

12 Jun 2025 1:08 PM IST

Like most cities and towns in India, Mumbai has its share of ugly black cables strung haphazardly across buildings connecting entire neighbourhoods to a central hub somewhere.

These cables have formed the basis of India’s ground-up, local entrepreneur cum sometimes muscleman led cable and satellite television industry revolution.

They have also existed all these years in a time-warp of their own.

The other, less ugly but equally obtrusive sign of this revolution has been multitudes of mini satellite dishes — broadly facing the eastern skies because there is no choice but to aim them in that direction — but affixed to balconies and rooftops, once again in a fairly random fashion and destroying the little aesthetic that there was.

Over the years, many apartment complexes have moved to a single, centralised dish antenna on the rooftop, which would then connect to multiple houses.

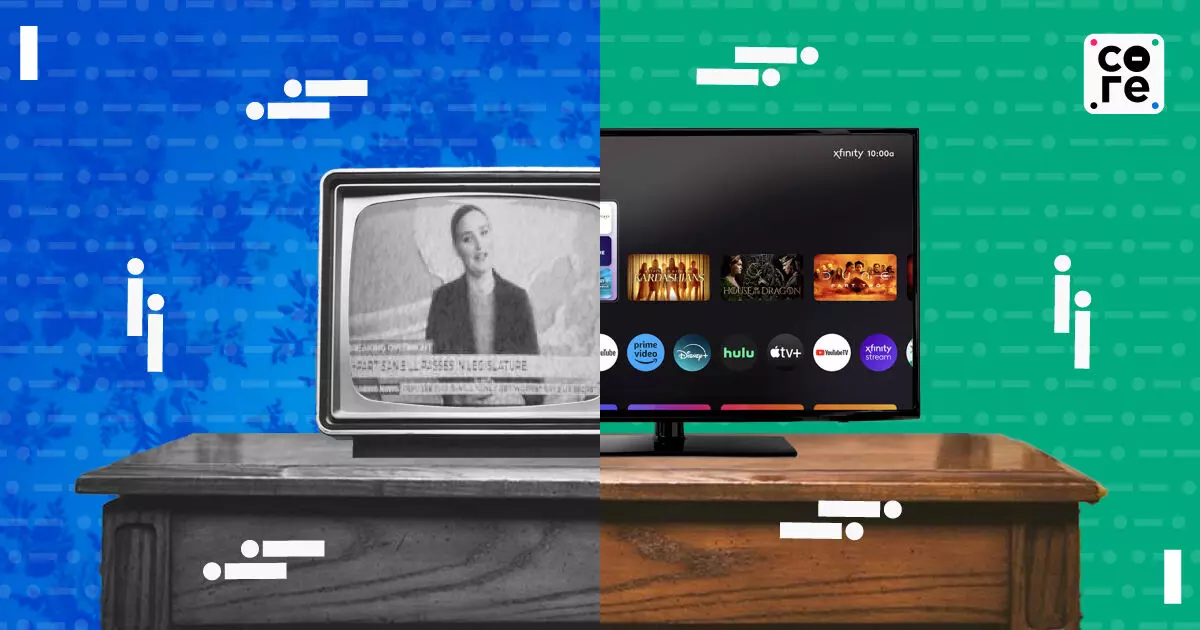

Digital Disruption

Dramatic changes are afoot.

An EY report quoted by Business Standard said a sharp drop in Pay TV subscribers from 151 million around seven years ago to around 111 million last year has led to a sharp contraction in the once burgeoning industry.

Significantly, the industry has reportedly lost over half a million jobs in the last seven years as consumers switched to OTT, smart televisions and free satellite television from state-owned Doordarshan.

The combined revenue of four major direct-to-home (DTH) operators and ten leading multi-system operators (MSOs) fell to Rs 21,500 crore in FY24 from Rs 25,700 crore in FY19, a decline of more than 16 per cent and payTV subscribers are expected to almost halve by 2030.

The decline in subscriber numbers and the resultant job losses is thus as much driven by changing consumer habits as by digital disruption.

These insights were released by the State of Cable TV Distribution in India report on Monday, published jointly by the All India Digital Cable Federation (AIDCF) and EY India.

A Warning Sign

These developments also highlight a classic contrast between jugaad principles, around which most of the cable industry operated, versus the challenges India now faces of upskilling its workforce to an AI-ready world.

And this should act as a warning to any legacy industry.

My own experience dealing with cable television operators and their collection agents has been less than memorable, and I have found an undercurrent of menace in every interaction in almost any city.

Of course, on the flip side, if you had just moved into an apartment and needed a cable connection urgently, they would do it for you in hours.

Most people would thus not be really sad or upset with the cable operator’s demise. In most cases, they would not have noticed.

The industry — made up of companies like Zee, JioStar and Sony — argues that linear television continues to be resilient.

They cite the 85 to 90 million households still paying for TV services as a sign of untapped potential, especially among DD Free Dish users and homes in media-dark regions.

The industry is still hoping that some 100 million homes in India, which do not have cable or satellite TV, could be customers for low-cost plans and affordable set-top boxes.

Consolidation Woes

But the industry itself has been in the throes of major consolidation moves in recent years.

Note that JioStar itself is a merger or buyout of Disney India, including Hotstar by Reliance and Zee and Sony had a long and messy courtship meant to culminate in a merger which fell apart at the altar.

Needless to add, the consolidation in the industry reflected precisely the problems highlighted by the report.

On the other hand, it is also possible that the industry’s growth has peaked, at least from a revenue standpoint or the desire or affordability of customers to pay.

And here on, it will be more about shifts and which platform or piece of content grabs the maximum eyeballs, revenue or subscription. Like IPL cricket, which has already drawn in billions of dollars of forward investments.

The Need For Upskilling

Back to the jobs question, while we can do with fewer cable guys or dish antenna installers, we still need last-mile connectivity since most heavy users of the internet have switched to fibre links directly to homes.

The difference is that you are now dealing with fewer employees of large companies like Tata, Airtel or Jio who mostly deal with entire apartment complexes rather than individual homes.

As opposed to interacting with the local entrepreneur.

Remember, many apartment complexes, new and old, themselves provide internal wiring and confine maintenance and repair to the junction boxes.

And the telcos now give you more intuitive software and apps thanks to which connections and routers can be set up in a jiffy. Or with a call to the call centre at best.

An increasing number of users also rely solely on smartphones thanks to ever rising mobile data speeds, including with 5G spreading across India.

In this shrinking market, the cable guy today has to be more qualified, digitally literate and work with more systems, processes and the latest technologies.

Looking back, while you could assign blame to governments and policymakers for not helping out, the onus also lies on businesses and workers to upskill and evolve.

It would also be good to reflect that an entire industry, in this case, cable to home, built on jugaad, would not last forever.

Zinal Dedhia is a special correspondent covering India’s aviation, logistics, shipping, and e-commerce sectors. She holds a master’s degree from Nottingham Trent University, UK. Outside the newsroom, she loves exploring new places and experimenting in the kitchen.