India’s Next Credit Boom Might Be on UPI, Not Plastic

Banks are pulling back on credit cards amid rising delinquencies, but QR-based RuPay-on-UPI is quietly gaining ground with frequent, low-ticket spends driving growth

India’s credit card engine is sputtering. After a year of heady growth, data released by India’s central bank, the Reserve Bank of India (RBI), for June 2025 shows that credit card spending slipped to Rs 1.83 lakh crore, down nearly 3% from May’s peak of Rs 1.89 lakh crore. It marked the lowest monthly spend since February this year. While year-on-year (YoY) spending was still up by a modest 5.7%, the real concern lies elsewhere.

It’s in the numbers that aren’t growing.

For the first time since the pandemic, net new credit card additions turned negative. As of June 30, the total number of credit cards in force stood at 11.12 crore — almost exactly the same as May, indicating that issuers added fewer cards than they retired or deactivated.

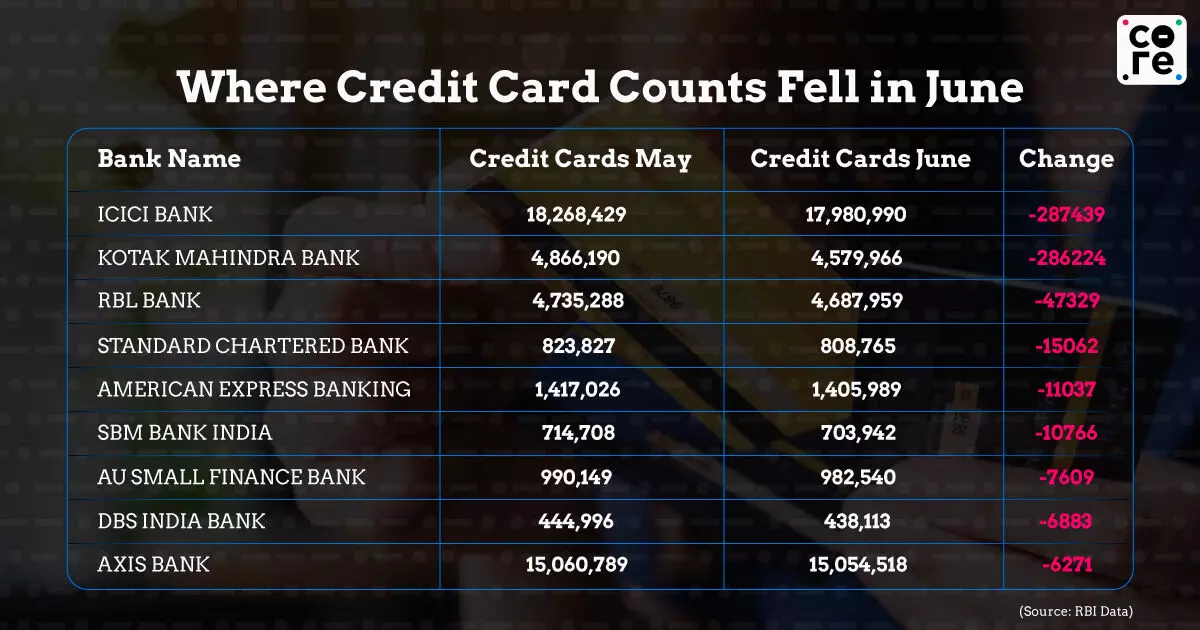

RBI’s granular data shows that top private lenders like ICICI Bank (–2.9 lakh cards), Kotak Mahindra Bank (–2.8 lakh), and RBL Bank (–47,000) saw the sharpest drop in outstanding cards. Even Standard Chartered and American Express reported declines.

India’s credit card engine is sputtering. After a year of heady growth, data released by India’s central bank, the Reserve Bank of India (RBI), for June 2025 shows that credit card spending slipped to Rs 1.83 lakh crore, down nearly 3% from May’s peak of Rs 1.89 lakh crore. It marked the lowest monthly spend since February this year. While year-on-year (YoY) spending was still up by a modest 5.7%, the real concern lies elsewhere.

It’s in the numbers that aren’t growing.

For the first time since the pandemic, net new credit card additions turned negative. As of June 30, the total number of credit cards in force stood at 11.12 crore — almost exactly the same as May, indicating that issuers added fewer cards than they retired or deactivated.

RBI’s granular data shows that top private lenders like ICICI Bank (–2.9 lakh cards), Kotak Mahindra Bank (–2.8 lakh), and RBL Bank (–47,000) saw the sharpest drop in outstanding cards. Even Standard Chartered and American Express reported declines.

This sharp pullback in issuances is being attributed to rising fatigue among new-to-credit customers and lower-limit borrowers, largely Gen Z and millennial users who were once the engine of unsecured credit growth. As The Core reported in April, this cohort—typically sanctioned cards with sub-Rs 50,000 credit limits—has seen mounting repayment stress since mid-2024.

Speaking with The Core, Aniket Dani, director at Crisil Intelligence, said that the slowdown in credit card issuance and spending can be attributed to a combination of factors, primarily driven by lender caution in response to increased concerns over asset quality and rising delinquencies in the unsecured lending space.

“The growth rate of credit card portfolios at banks, which had been growing at a 19% CAGR between fiscal 2020-25 moderated to 11% in fiscal 2025 and further to 8% on year in May 2025. The number of new card additions decreased from 16.5 million in fiscal 2024 to 8 million in fiscal 2025,” Dani said.

That stress is now showing up in the system. The drop in issuances isn’t just a market recalibration — it’s a signal that the credit card segment is entering a period of strain for banks, with early warning signs having appeared as far back as early 2024.

Amit Das, chief executive of Think360.ai, a data intelligence firm that works with banks and fintechs on credit risk modelling, said the latest RBI data signals emerging cracks in India’s credit card growth story.

“Think360.ai’s analysis shows that transactions per card fell 3%. Balance rollovers spiked 180 basis points in six months. Delinquencies, especially cards that are 90 days past due, hit 3.6%. Credit-card NPAs went up 28% to Rs 6,742 crore (in June),” added Das.

RuPay Cards Defying Trend

While traditional credit card issuances and spending have plateaued, RuPay credit cards linked to UPI are quietly breaking away from the trend.

The segment — still a relatively new innovation — has seen rapid uptake over the past year, thanks to high-frequency, low-ticket usage enabled by QR-based payments at everyday touchpoints.

According to a January 2025 analysis by Kiwi, a fintech that issues RuPay credit cards on UPI, users in this segment average around 40 transactions per month, nearly eight times higher than traditional credit card holders.

That surge in activity has helped RuPay expand its share of credit card transaction volume from just 3% in 2023 to 12% in 2024, Kiwi said in a report in January. And the growth has continued into 2025.

In an interview with The Core, Mohit Bedi, CEO of fKiwi, estimated that credit-on-UPI currently accounts for nearly 10% of the Rs 1.83 lakh crore in monthly credit card spending.

RuPay-on-UPI is gaining momentum mostly in offline touchpoints that utilise QR-led payments, including kirana stores, supermarkets, and other brick-and-mortar establishments. Bedi said that around 85% of Kiwi’s transactions are offline QR-based transactions over UPI.

Kiwi operates something akin to a Buy Now, Pay Later (BNPL) model, but through a more regulated lens. Unlike typical BNPL apps, Kiwi does not lend directly. Instead, it functions as a distributor of credit cards, partnering with Yes Bank and Axis Bank to issue RuPay credit cards that can be used seamlessly over UPI.

Kiwi’s revenue model, Bedi explained, is rooted in distribution and transaction-based commissions.

“We get paid for every customer we acquire and for the spend that follows. Banks struggling with quality portfolios have started recommending Kiwi because of our strong repayment metrics,” he said.

But the fintech’s bet isn’t just on QR-led convenience—it’s on borrower quality. According to Bedi, more than 95% of Kiwi’s users are already credit active, with existing credit cards or loan histories. Only a small percentage are new-to-credit (NTC).

“Our average credit line is somewhere around Rs 1-1.5 lakh,” Bedi said. “While we do target both new-to-credit and credit-active customers, over 95% of our current users already have a credit history, either through existing cards or loans.”

This behavioural shift is translating to scale. Kiwi’s data shows that RuPay’s share of total credit card transaction volume rose from just 3% in 2023 to 12% in 2024, and continues to grow. Looking ahead, Bedi expects credit-on-UPI to grow to 18–20% of total credit card spending by next year, driven by widespread offline adoption.

“The number of QR acceptance points is about 30 times more than PoS terminals—driving expansion. Offline adoption, even in remote areas without electricity, is easier with a static QR code than PoS machines,” he added.

The Risk Beneath The Rise

Even as credit-on-UPI surges ahead, the broader credit card ecosystem is flashing early warning signs.

According to the latest CIBIL Credit Market Indicator (CMI) report, growth in credit-active consumers slowed to just 8% year-on-year in March 2025, the lowest in three years. While credit penetration among the 25–35 age group remains the highest at 33%, growth within this cohort has clearly plateaued.

More worryingly, delinquency levels are inching up. The report shows that the 90+ days past due (DPD) rate for credit cards rose from 1.91% in March 2024 to 2.0% in March 2025, signalling marginal but persistent stress. Alongside credit cards, consumer durable loans also remain among the highest-risk segments, with early delinquencies (30+ days past due) showing an upward trend.

This can be traced back to the fact that credit card utilisation ratios hit 48%, up from 41% last year, reckless compared to the 30% benchmark, as shared by Das of Think360.ai, which offers underwriting solutions to banks and fintechs.

“All this does not imply that the growth phase is over, but maybe reckless expansion is. Banks must invest in more first-party data, through creative collection and consent, and for nuanced underwriting. Some of the larger banks will stay conservative and focus on traditional underwriting models, restricting supply,” added Das.

CIIBIL research data from June confirms the same. Most new credit card originations are now concentrated among borrowers with scores above 731 (prime and above). At the same time, originations to subprime borrowers — those with scores below 681 — have declined significantly.

This means that the very customer segment Kiwi is targeting — existing, credit-active users with strong repayment history — is also where the competition is heating up. As banks prioritise portfolio quality over aggressive expansion, the fight for reliable borrowers is only expected to intensify.

Banks are pulling back on credit cards amid rising delinquencies, but QR-based RuPay-on-UPI is quietly gaining ground with frequent, low-ticket spends driving growth