No Quick Fix: Industry Says Tariff Relief Will Take Time

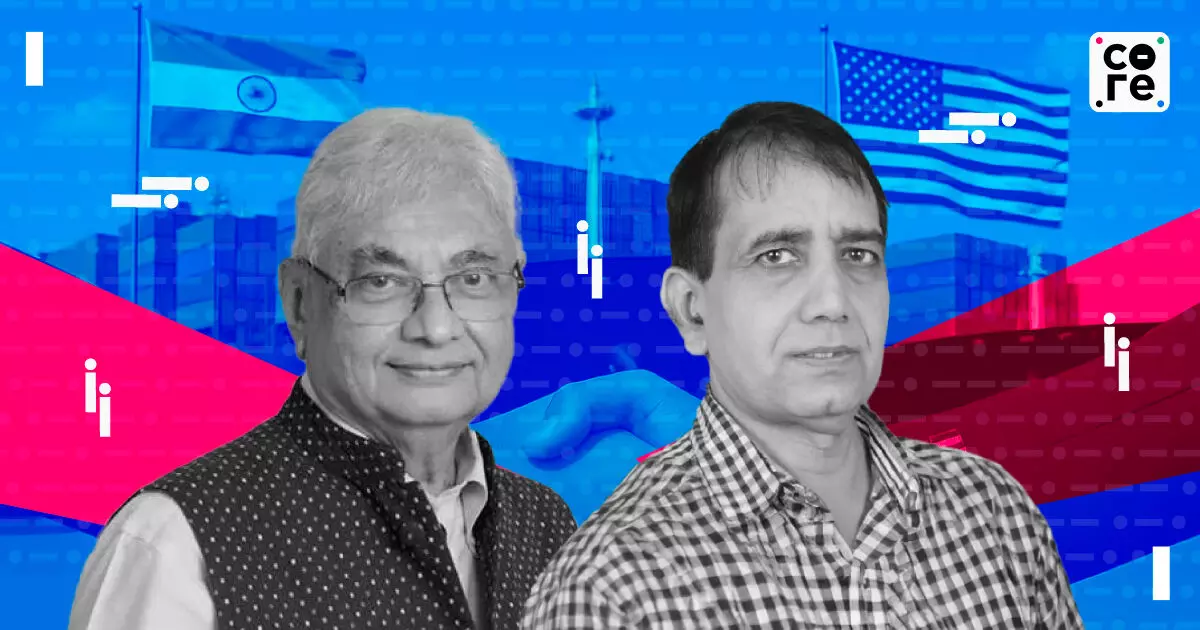

In this week's The Core Report: The Weekend Edition, Govindraj Ethiraj speaks to Rahul Mehta, head of the Clothing Manufacturers Association of India and Ajay Srivastava, founder of the Global Trade Research Institute, about how India can respond to shifting US tariffs. Both stress that Plan B lies in diversifying exports to new markets, negotiating trade agreements, cautiously using incentives, and pushing long-term reforms—while warning that quick fixes or heavy subsidies are unrealistic.

NOTE: This transcript contains the host's monologue and includes interview transcripts by a machine. Human eyes have gone through the script but there might still be errors in some of the text, so please refer to the audio in case you need to clarify any part. If you want to get in touch regarding any feedback, you can drop us a message on feedback@thecore.in.

Hi and welcome to The Core Report's weekend edition. So, the government is now talking about export schemes worth about 25,000 crore rupees under the export promotion scheme, which will essentially help industries and companies within that against the tariffs or the high tariffs that they are likely to face, which could go up to 50% by the end of August, that's August 27th. Now, whether that happens or not, we don't know at this point, things could change, but it is a fact that we are in a new world of near permanent uncertainty.

Things could change after three years when there's a change in government, but the uncertainty is definitely long enough to involve and necessitate strategic response and strategic change, both at a policy level in the government of India and as well as at a company and industry level. So, let's try and understand and we'll broadly put it under the bucket of plan B, essentially what should be the plan B or what is the plan B, given that we are now in a way saddled with this uncertainty going forward for exporting industries and particularly companies that are exporting or industries that are exporting to the United States of America. At this point, we of course don't know whether tomorrow if other countries can get dragged into it.

Remember that the United States once again has said that even Europe should impose sanctions on India for importing Russian oil. So, that may not happen, but that's another thing to think about for those who are thinking about that. So, to discuss this, I'm joined by Rahul Mehta, head of the Clothing Manufacturers Association of India and also Ajay Srivastava, founder of the Global Trade Research Institute.

Thank you both for joining me. So, let me start with you, Mr. Srivastava. So, my question, like I said earlier in the introduction is, what is our plan B?

We've so far talked about our situational response to what these tariffs or the tariff impact could be from either a policy level and particularly from a policy level. But now it looks like policy may not be able to respond in the way we want because it's just too fast changing an event.

Ajay Srivastava

I can think of three components of plan B. First is trying to export more to other countries. That means we expedite our free trade agreement negotiations with them or solving the specific non-tariff barriers faced by India in those countries other than US.

Second is, as you rightly said, announcing some incentives. But there we have to see, suppose we announce incentive at the rate of say 10%, we have to know what's the cost disability. 50% is too high.

10% may not be able to make it. Beyond that, we cannot give. So, we have to be very careful that money should not go into the drain.

And of course, third and the best and long-term thing is that we do some fundamental reforms in making better things.

Okay. So, I'll come to all three points in a moment. Rahul?

Rahul Mehta

Well, I guess plan B is a no-brainer in the sense as Ajay mentioned. I think the first and foremost responsibility, and that lies more with the industry than with the government really, is to open up new markets. And when I say open up new markets, perhaps focus a little more on these markets because all said and done between US and EU, they constitute about 65% of the world trade in any case.

I'm talking about apparel. So, you don't have that much of a choice. So yes, you can go to Australia, New Zealand, Japan, UK, etc.

But these are all going to be sort of supporting characters. The main player will be EU. The only concern that I have is that plan B in this case is not going to be an immediate alternative to plan A.

Because all the measures that we can take or should take and will take will be slightly longer term in nature. Customers do not switch to you simply because you are in a problem with the US. It takes time for them to build their confidence, to get you to understand their requirements, for you to actually understand your customer better.

So, it's going to take time. So, I'm afraid there is no plan B to an immediate suffering that the industry is going to face. As I think Ajay very correctly pointed out, you can't expect the government to subsidise our exports by 50%.

That's not going to happen. As you are well aware, even for the return of taxes like ROD, PL and whatever ABCD that we have, the battle between the industry and the government is about whether it should be 2% or 2.5% or 3%. So, the government just doesn't have that kind of money or the resources to bump into one particular segment of our total industry.

So, subsidies is not the answer that can only help to a little extent. The government steps also, such as persuading the banks to be a little more liberal and flexible about lending to the exporting sector as well as reducing the rates. Now, unfortunately, this is where our democratic setup perhaps comes in the way of quick solutions.

Because just the other day, after reading the finance minister's statement that they will persuade the banks to be a little more flexible, we got a statement from one of the bankers to say that we will now be looking at lending to exporters a little more closely because of their ability to repay. So, it's not going to be an easy task.

Right. Okay. Now, can you recap for us what's been happening in the last three months?

And this is a specific question. For example, if you look at some of your larger exporting members in apparel and to the United States, we've already been living with 10% and now, of course, it's 25% as of last week. So, how have companies been adapting to this?

If at all they've been adapting, what has been the flow of export orders in this particular time since April 2nd, which is when the new deal was announced?

Rahul Mehta

On a slightly lighter note, I think the Indian exporters have taken Shakespeare a little too literally when he said that hope lies eternal in the human breast. So, I think everybody just kept hoping that even that 10% was going to go down or the other countries were going to be in fact imposed with a higher level of import duties. And therefore, instead of taking corrective or defensive measures, many of us were planning as to how to buy the next BMW or the next Audi because orders were going to flood into the Indian market.

That didn't happen. So, I don't think in the last three months, except a few, they will always be the super guys and they have been shifting a part of their orders to their other factories, which are in the other countries outside India. So, some of them have done that.

Some of them have started discussing and negotiating with EU customers and UK customers. Also, because I think no matter what the concluding sort of state of import duties are, there is no doubt that the industry is not going to put all its trust into the American market. Now, even if it were to by some miracle, the duties were to come down to zero, they will still say that, look, you never know when the next Trump comes up or when Trump comes up with his next measure.

And therefore, I don't think they will trust America that much as of now. Where I'm a little more worried are the MSMEs because they are the ones who probably would have just two or three customers on their rolls and they would tend to be within the same country. So, there would be a lot of exporters who only deal with America.

For them, it's going to be that much more difficult to switch because the product requirements, the compliance requirements, the scales requirement are all very different between America and the rest of the world. So, it's, as I said, not going to be an easy task. But unfortunately, I think now the exporters have started waking up and trying to look at other markets.

For example, I know some of the bigger exporters have started talking to the Reliances and the Aditya Birla and the Arvind Groups for an entry into the domestic market. So, that is a definite possibility that I foresee.

And just to come back to the exports, you know, I'm sure there is a split. I mean, you have some orders or maybe a large percentage of orders which are going to big retailers and therefore the pipeline is much longer. So, those deals would have been struck six months to one year ago, maybe even shipping started earlier and has been tied up.

And there could be other kinds of buyers, maybe small chains, but I'll leave it to you to explain, who are obviously buying more short-term or on shorter cycles. Broadly, what's the split? And to that extent, is there any breathing space still left or have we now come to the end of the runway?

Rahul Mehta

Well, you know, this is a problem of the orders which are already in the pipeline. And there could be orders which the goods are already produced, some which could be in transshipment.

The negotiations are on. The American buyers are also aware of the fact that, you know, the existing prices will not be able to sustain the tariffs, additional tariffs. So, this is where one-on-one discussions and negotiations are going on.

I foresee a fairly major quantum of loss for the Indian exporters because even the American retailers, all said and done, they have a certain limit beyond which they cannot suddenly overnight increase their prices to the consumers. And that is another issue which I am not so sure whether Trump and his government has taken into calculation as to how much would the American consumer be able to afford a higher price. Because even the countries which have got a lower level of tariffs, it is still indicating a price increase of 15 to 20 percent.

So, that's not something that a consumer would sort of very happily pay overnight. So, that's where the problem rises.

Mr. Srivastava, can I come back to the support? And you said, you did point out some of the challenges of, you know, offering support to a particular industry and whether it should not go down the drain, to use your term.

So, can you walk us through what is feasible and what is not? And what is our experience in the past? I mean, while this is something that we've never seen before in this scale, exporters have always faced some level of challenge or the other in this globally, I mean, in a market which has sort of increasing levels of international trade.

Ajay Srivastava

So, let's first rule out what is not possible. For example, if government says, for anyone exporting to U.S., I'll give this 10 percent extra. That should be ruled out from the beginning because U.S. is going to countervail immediately that they will charge 10 percent extra duty. It has happened in the past. It will happen now also. So, government should take care that whatever measures are announced, they are not U.S. specific. They have to be general measures. Then what should be done? Right now, I think 50 percent is too large a margin to be compensated by any trade measures.

So, we should focus on increasing general competitiveness of the exporters, which means bringing more domestic manufacturers into the field of exporting who may not only be exporting to, I mean, the U.S. is not possible, but all other countries. For this, we had one beautiful scheme. It was called Interest Equalisation Scheme.

It was a small scheme, 2,500 crore annual expenditure available mostly to the MSMEs, not to the larger firms. But I think that scheme, it was withdrawn last year and that needs to be introduced again. It needs to be expanded from 2,500 crore to 15,000 crore so that it covers everyone.

It will increase the general competitiveness. When you have a budget of 15,000 crore rupees, almost equal to the drawback scheme budget. Don't need to touch the drawback or draw tabulates.

If you increase, then exporters' interest burden will almost go, it will become zero. And that will bring, that will create many thousands of new exporters. They will become competitive suddenly in the smaller market, not in the U.S., but other markets. So, I think that focus should be there. And it will be difficult to counterbalance this immediately when we are not targeting U.S. again. So, I think first focus should be this.

And then there are many things which small exporters face and we all know, like why we can't make all the regulatory filing online, all the processing, why exporters have to run to DGFT, Customs, Shipping Ministry differently. That may be a medium to long-term project. But if that happens, we can see the entry of 2, 3 lakh small-scale firms who supply their goods to the, say, export houses.

They can start exporting again. So, all I'm talking is this is the time to improve the general competitiveness by bringing, by taking measures. So, more and more people start exporting.

Rahul Mehta

Can I just add, as I said, I absolutely agree. But one of the major reasons for us not being very competitive, especially in the man-made fibre segment, are the high import duties that we levy.

And also on imports of cotton, there are restrictions, there are import duties, etc. I think this is what government needs to do at an immediate level, which is to make our imports cheaper. We are a unique country, if I may say so, which encourages competition on finished garments and protects the raw materials and the inputs.

I mean, it just simply doesn't make sense because the higher the value chain you go, the more is the value-add, the more is the export value. So, I think the government needs to re-look at this basic strategy of theirs and make sure that the inputs and the raw materials are available to the exporters at the minimum level of price and therefore, encourage exports of the finished goods. Sorry, that was one which I wanted to add.

Yeah, I mean, so, Mr. Srivastava...

Ajay Srivastava

Rahulji, thanks very much for raising this issue. I will just elaborate and support his point.

See, world over, 70% of the garments sold, they are non-cotton. They are synthetics, sportswear, mixed and all these. Okay, 70%, those including winter fairs, 30% cotton.

What we export is just the reverse. Our 70% is cotton, 30% is synthetic. Why?

The point Rahulji has raised is this. We have made the imports cumbersome, expensive by allowing tariffs, by imposing QCOs, quality control orders, which check any sane imports for most of the people. And they are forced to buy local material, which is as high as, I mean, it may be 20% more expensive.

Unless government addresses this, we can never achieve our potential in garment exports.

So, Rahul, I wanted to come back to you on the point that Mr. Srivastava made about 200,000 to 300,000 smaller manufacturers coming in. So, I don't know whether that makes economic sense right now.

But the question really is, if we were to ease up procedures, you talked about dealing with Director General of Foreign Trade, Customs, Banks, so on and so forth, and multiple filings everywhere. Can that change things?

Rahul Mehta

Yes, to some extent, because one of the reasons why a smaller manufacturer, I'm talking more of the micro and the small level of the MSME sector. The one reason why they prefer the domestic market is it's a simpler market to work in, rather than fill up hundreds of forms and apply and go through regulations, inspections, and so on. The domestic market is much more informal, flexible, and sort of easier to operate in.

I don't think too many of these manufacturers would be willing to switch to exports simply because of 3% to 5% or 10% additional incentive. When there was a major sort of growth in the number of exporters, of course, total exports went up significantly, but in the number of exporters was when the income tax-free regime was announced. That was a time when everybody sort of jumped onto the bandwagon, because that was unheard of prior to that.

So, some kind of a major decision of that level, I think, will be called for. Why not? It's WTO compliant, to the best of my knowledge, and it will encourage a lot of small people.

Again, the government needs to understand. One of the weaknesses of our bureaucrats, I think, is that they would rather make 95% genuine exporters suffer or genuine businessmen suffer, so that five non-genuine businessmen don't get away with some kind of a steal. So, yes, some people will take advantage.

Some people will show part of their domestic business as export business. All these things will happen, but at least, I think, on the overall level, exports will boom and we'll probably be able to compete in the world market. So, I would strongly recommend something like that.

Otherwise, all banking measures, as Ajay ji suggested, the import sort of issues or measures, all these will help, but it won't bring too many of the MSME manufacturers into the export fold.

Mr. Shrivastava, just to kind of go a little deeper into the raw material and the import of it, and we've made that distinction between man-made and cotton, where we are exporting more cotton than we are exporting man-made fibre-based products. So, what's the way forward there?

I mean, if we were to bring down duties, let's say, would that not solve the problem, but could that make things much more easy in a high-tariff environment?

Ajay Srivastava

See, understand, Bangladesh doesn't have a very evolved textile value chain. They don't have much of the textiles. They import fabric, convert into high-quality garments, and export it.

And they are ahead than us in exports. They're just behind China and Vietnam. So, if we have to target this, then we have to be very clear what we want.

Either you want us to start from the basic raw material that is grown or made in India, it's not possible to compete at the international level. It's not possible not only in apparels, not possible in any sector, engineering, everywhere. We allow imports freely almost everywhere.

See the extreme cases, smartphones. We allow up to 90% import to make their smartphone. Apparel sector, that fundamental thinking needs to be changed.

There are certain domestic interests. That's why we are not able to take effective steps. Earlier, we were imposing anti-dumping duties.

Now, we are importing through QCOs. So, we need to go deep. Everybody knows the solutions.

We need to take steps. There's no point debating this. The solution is very clear.

Rahul Mehta

Everybody knows the problems and everybody knows the obstructions to those solutions.

For those who don't understand this, obviously, there are a couple of producers, let's say for man-made fibre, which is polyester staple fibre, there could be one producer for viscose staple fibre. So, these are local producers and obviously, they benefit if tariff levels are high or there are quality control orders, which are effectively non-tariff barriers. Now, my question is, if that were to be addressed as a singular focus, would that change the fortunes for garment manufacturers, at least to some extent?

Rahul Mehta

See, Govind, I think one of the mistakes that both the government as well as the industry leaders make is that they fail to look at the issue in a comprehensive and holistic manner. We tend to sort of pick up one issue and say, solve this and we will conquer the rest of the world. That doesn't happen.

Now, for example, you are talking about this. Yes, sure. That will definitely help resolve a lot of problems.

But then what about the skills? Are we ensuring that Indian factories also build up the kind of skills that are required to compete in the world market? Are we ensuring the labour laws that will encourage us to compete in the world market, the banking sector, for example, the cost of money, which I'm talking about.

So, where I think we go wrong is not to look at the entire problem of doubling or tripling or quadrupling our garment exports within the timeline set 2030 or 2035 or whatever. If somebody were to say, all right, these are the 10 things that are required to be done, and at least do 8 out of the 10 things, then I think there is a scope and a chance. Now, I'll give you a classic example.

You know, the industry has been saying for decades now that India lacks scale of production. And the government tried to resolve that by these mega parks, the APM parks and so on. That was a brilliant idea.

The PLI was an excellent idea. But now look where we went wrong in the details. Now, the PLI minimum investment requirement for textiles has been set as a sector as a whole.

Now, the investment required for a textile company or putting up a spinning company or a weaving company is far, far more than putting up a garment factory. Now, 100 crores, 200 crores, 300 crores investment is not even thinkable for a garment company, leave alone tempting. So, you must have seen, first of all, the PLI's scheme success in textile has been the least of the other sectors.

And within that, there has been hardly any, if maybe one or two garment manufacturers who have applied for it. This is where the government has to understand that one or two Shahis are not going to take our exports from $16 billion to $40 billion. It's not going to happen.

You require hundreds of these Shahis to come up. And that is where if the PLI scheme had been kept aside separately for the garments, then I think you are talking business. If you invest 10 crores or 15 crores in a garment factory, you have got a giant on your hands.

And again, putting up a 15 crore investment limit for a textile mill doesn't make sense. So, for a textile mill, this 100 crores limit is a good one. But for garments, there should be a PLI-2, which has always been threatened for the last couple of years, but not been implemented.

That will make some kind of a sense.

Mr. Shrivastava, one of the points you mentioned, I just wanted to, so that people understand this, you talked about countervailing duty, which could be imposed if we were to give, let's say, a 10% rebate or a 10% concession. Now, I understand that even other industries, for example, seafood exporters, they already face countervailing duties from the United States, which was not so clear to people like me, maybe who are sitting outside.

Can you just walk us through what are some of those things that are already in force?

Ajay Srivastava

So, US and Europe and China and also India, all these countries, they impose anti-dumping duties on the imports, certain imports from the other countries. And so, right now, US and Europe, they are one of the largest users of, they impose anti-dumping duties whenever they get a request from their domestic industry that imports from a particular country are hurting them. It may be right, it may be wrong, but it's a domestic decision.

Investigations, they happen, they visit the host country, for example, they want to impose against Indian shrimp, they will come and meet the shrimp exporters, meet the commerce ministry officials, all those things. Ultimately, decision is exclusively in their hands. And generally, it goes to the favour of the domestic industry.

We also do almost the similar thing, we also protect that. So, it's a worldwide phenomenon. And half the time, full reasons may not be there.

So, right now, US is imposing, say, on our steel, aluminium, and many, many, at least 100 chemicals, and many of the agriculture products, and shrimp, and all those are there. So, I don't say it's something outlier, it's a measure everybody uses, and most users are US and Europe.

No, so the point is that these specific product categories are already facing high levels of duty even before this 25 plus 25. And my question really is that, so it's 25 plus 25 plus what's already in force?

Ajay Srivastava

So, 10% currently is the anti-dumping plus countervailing duty on shrimps. So, it will be 10 plus 50 will be 60% because MFN tariff, fortunately, is zero. So, it will be 60% on India.

So, we started by asking, what should be our plan B? So, let me come back to that. And we've got a bunch of events happening. There is a meeting between Russian President Vladimir Putin and US President Donald Trump on the horizon.

There's our own efforts to negotiate. There's a visit by India's Prime Minister, Narendra Modi, first to China, then maybe, if I go by some reports, to the US, but that's in September. So, all of this is hopefully or likely to provide some or result in some solutions, but we don't know at this point of time.

So, to come back to the primary question, let me begin with you, Mr. Shrivastava. So, what should be our plan B at this point, just to sum up?

Ajay Srivastava

We should just keep quiet, don't do anything, do your internal reforms, do you set your incentive schemes in order, help your exporters diversify here and there, because this is not final. The way US officials and President is talking, more tariffs may be coming, or there may be some many things which we don't understand may happen. For example, I saw in the past one week, I saw at least two or three Trump's remarks on Truth Social, that everything on tariff front is going all right, only one thing can jeopardise everything, is that some US court knocks down the tariff.

So, something is happening, they have been outlawed already, something may happen there. Or like these tariffs were postponed for 90 days in April 9, because suddenly stock markets fall. Now, tariffs are on all countries, it's not only issue for India, everybody is facing tariffs higher or lower.

There will be a problem, it's possible if problems go beyond certain limit, he may again be forced to postpone it. So, many known unknowns are there and unknown unknowns are there. We may witness all those things in the next few months.

So, I believe next few months, Trump, whatever extra he wants to impose on India or give some concessions, because he had reached a deal with Russia, we'll come to know everything in two, three months. We should respect our red lines. Beyond that, we should offer everything, all flexibilities to the US, they are our largest trading partner.

And then relax, don't come under tension.

Rahul, you talked about having lost trust. And that's an important thing, because that in turn determines strategy and how industries or in this case, your industry will approach the near future and maybe the distant future as well when it comes to trading partners or new deals. So, what would be the way forward then?

Rahul Mehta

See, I personally don't believe in this plan B, because the rate at which the situation and the circumstances are changing, I think you need to plan X, Y and Z, rather just plan B. So, my suggestion or my advice would be to all the exporters to not plan on the basis of the current US tariffs or even tariffs as such. I think they should plan their strategies, future strategies on the basis of a learning that we have got in 2024 and 2025.

And broad base their business exposure, whether it is between exports and domestic or within exports between the US market, the European market, and why just the Western market. We've got an ongoing FTA with Japan, which nobody seems to be using. We've got an FTA with the Middle East, where the sales have actually gone down after the FTA was joined.

So, I think we need to broad base our markets. We need to broad base our products so that we minimise the risk in any of our business operations. I won't name the company, but there is a garment exporter today who has manufacturing facilities in India, Bangladesh, Vietnam and Indonesia.

So, at this point of time, when the rest of his colleagues are shaking their heads in disbelief and not knowing what to do, this guy is laughing every day to the bank because all his customers are saying, look, our orders are on. We're in fact increasing our orders on you, but make sure that you produce it in Bangladesh. Make sure you produce it in Indonesia.

And he's got an option of four manufacturing units where he can supply his goods from. So, that's what I'm trying to say, that everybody may not have the resources to have five factories in five countries, but broad base your manufacturing setup, broad base your market setup and broad base your product base. I think these are strategies that you need to do regardless of what happens to the American tariffs.

Mr. Shrivastava, the last question for you. So, having seen from your earlier vantage point at DGFT and now as a researcher, do you think we can come out of it?

I mean, assuming all these things stand roughly where they are, maybe with some slight changes, which is obviously puts us at a disadvantage. Do you think we can come out of it? Do you think we will?

Because there is fear now. I mean, there is fear that jobs will be lost. There is fear that factories will be shuttered and smaller enterprises will face a bigger brunt.

So, how are you seeing us? And when I say us, I mean both industry as well as government may be working together to some extent.

Ajay Srivastava

Everybody understands there will be pain, but we also realise that exports are 20% of our GDP. For Vietnam, they're 90%. We are not Vietnam.

And US is just one fifth of our market. So, pain will be there, but we are going to be stirred, but not shaken too much. I think within few months of certain loss, we'll be starting recovering.

And you're saying that recovery will come because we'll redirect our exports elsewhere or redirect manufacturing to domestic consumption or something else?

Ajay Srivastava

As Rahul ji is saying, what happened to China in the last trade war? China started exporting via Vietnam, via India, via Mexico, other countries. So, as Rahul ji is saying, many people will be talking to their friends in Bangladesh, Indonesia, Vietnam for supplying to them and making things there and exporting.

So, some pain will be assuaged. Of course, pain will remain. It will not go fully.

Rahul Mehta

Also, at the macro level, Govind, if I can just put it in perspective, the total apparel manufacturing in India is to the tune of about 120 billion US dollars, of which 95 to 100 billion dollars is the domestic market and 15 to 16 billion dollars is the export market. Out of the 16 billion dollars, the US market constitutes about 30 to 35 percent. So, you're talking about five and a half to six billion dollars.

Now, overnight, the orders are not going to go down to zero. You already have completed one water. So, you are really talking about two to three billion dollars worth of impact on the total industry, which is approximately 120 billion dollars.

So, I'm not saying that there is no cause for concern. I'm not saying that individually, there could be massive hits and massive losses and impacts. But if you look at it at a macro level, I think this perspective is also required to see how serious and how grave the total impact of this tariff war is going to be.

And I mean, it's exactly at this time Standard & Poor's has raised its rating on India, which was quite unexpected, actually. So, the economy or the perception of India's economy is actually technically at least stronger than what it was a few days ago.

So, on that note, thank you both for joining me. And it was a pleasure speaking with you.

Rahul Mehta

Thank you.

In this week's The Core Report: The Weekend Edition, Govindraj Ethiraj speaks to Rahul Mehta, head of the Clothing Manufacturers Association of India and Ajay Srivastava, founder of the Global Trade Research Institute, about how India can respond to shifting US tariffs. Both stress that Plan B lies in diversifying exports to new markets, negotiating trade agreements, cautiously using incentives, and pushing long-term reforms—while warning that quick fixes or heavy subsidies are unrealistic.

Zinal Dedhia is a special correspondent covering India’s aviation, logistics, shipping, and e-commerce sectors. She holds a master’s degree from Nottingham Trent University, UK. Outside the newsroom, she loves exploring new places and experimenting in the kitchen.