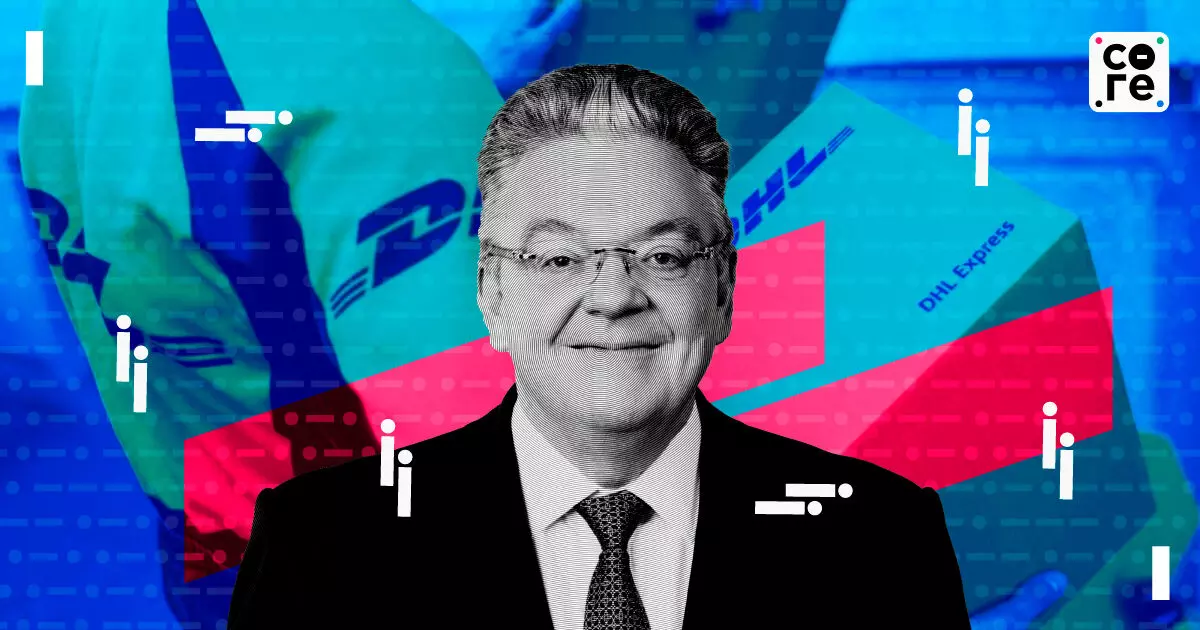

India’s Manufacturing Push Needs Faster Policy and Digital Ports: John Pearson, Global CEO of DHL Express

This week on The Core Report: Weekend Edition, Govindraj Ethiraj speaks with John Pearson, global CEO of DHL Express on how India can grab a larger manufacturing share with quicker policy changes, clearer trade rules, and digitalised ports.

NOTE: This transcript contains the host's monologue and includes interview transcripts by a machine. Human eyes have gone through the script but there might still be errors in some of the text, so please refer to the audio in case you need to clarify any part. If you want to get in touch regarding any feedback, you can drop us a message on feedback@thecore.in.

Hi and welcome to the Core Reports Weekend Edition. I'm joined by John Pearson, CEO of DHL Express and member of the Board of Management Deutsche Post AG Division. Thank you so much for joining me, John.

So, it's been six months now since the famous infamous Rose Garden announcement by Donald Trump unveiling a whole series of tariffs across the world. So, India, where we are right now, has been a particular beneficiary of his generosity. We've now been facing 50% tariffs on most exports, particularly labour-intensive industries, which also travel a lot, using perhaps your system or some of it at least, to the United States.

But the rest of the world is continuing as normal or as close to normal as it can be. So, let me start by asking you, what's been the most exciting moment in these last six months for you from your vantage point?

Well, being the experts in exports and the most international company whose competence is trade, there hasn't been many exciting things in terms of the tariffs themselves. But I can answer the question because I think the absolutely most exciting thing as the experts in exports is mobilising our great colleagues and employees in DHL Group, DHL Express, to meet with customers and share how we can help them get through this tariff situation, which, let's be clear, is affecting the top-line sales and the bottom-line profits of companies all over the planet, small and large.

Whether it's right or wrong to do this stuff, it is affecting people. And the exciting thing has been seeing how we can get closer to our customers and explain what we can do to help them be successful. And as I've said many times, we should never underestimate the creativity of buyers and sellers who want to do business.

There's a problem out there now, and people are realising that trade is part of the solution. And that's one of the most exciting things. And as I've often coined a phrase that, you know, whilst one country appears to be retreating from global trade, 219 others are embracing it.

So I think there's some really interesting dynamics going on here. But the most exciting thing is that this is what we're good at. This is what we do.

We have deep pockets and deep resources. We can go to our customers and say, we know this lane is going to be more challenging for you now. Can we help you find other lanes, especially for the e-commerce customers, or help you identify how you can keep your supply chains going effectively?

And there'll be some things you fix, there'll be some things we fix, bonded warehouses, duty drawback, break box solutions, etc. We can get through this. That's been the most exciting thing.

So you talked about creativity and how businesses are using or being more creative in the way they're approaching this problem and in the context of tariffs. Can you give us an illustration?

Yeah, a couple of things. One that sort of hasn't happened yet, but an illustration of something that has happened. I think what's exciting here is concentrations of manufacturing are going to change.

Now, that takes time to change, but people are automatically and already thinking about whether they move their manufacturing base from one country to another. A good illustration, though, to your question of something that has changed is that almost overnight, and I'm exaggerating, and I would say over two or three or four weeks and slightly before Liberation Day, a huge swathe of the laptop production consumption market for the US switched from China to Vietnam. If you saw it on a line graph, one goes down overnight and one goes up overnight.

That's very exciting for us because the first question from me to my EVP of network operations and aviation, do we have an aircraft going in? Do we need more aircraft going into different cities? Are we ready to take the lift and the capacity out of Vietnam to the US?

Because this is a very dynamic shift change. There's lots of things. There is, don't forget, a little bit of a wait and see mentality from a lot of customers.

I was talking to a very interesting lifestyle industry customer just this morning. Carpets, textiles, sending into the US from India, 50% tariff. They've already created some different schemes to keep flows going.

You said that sales are still high, commented that maybe the Indian administration and the US administration come to a deal in November. As I say, who knows when the deal will be? Not me, but we know we can keep going with providing solutions to that company until that time.

I very much hope and think that you can't get badder than bad. When something is bad, it's already bad and maybe it doesn't get worse than that. A lot of deals have been done.

We're opening newspapers three months ago and there's 17 updates a day. Now in the financial times, I find it hard to find new illustrations. A lot of deals have been done.

India is due to be done in the coming months. There'll be a lot of interest on that. And then is it all forgotten?

No, but deals are in place.

As we speak, the UK Prime Minister is in Mumbai and there is a UK-India free trade agreement as well that's been signed. There's a EU one also on the anvil. What do these represent to you?

These are all great opportunities. On one side of the coin, the UK was quick to strike some deal with the US and get their 10% level vis-a-vis Europe, which was 15%. Lots of work and water yet to go under these bridges, but it seems like 10 and 15.

They did the deal there, but this is a great illustration of how people are looking to do other deals now. India are out there with EFTA and out there with the UK deal and out there with other deals, cosying up to other partners and recognising that they've got a heavy tariff on the US and that necessity is the mother of invention. You have to look for new markets.

I just like this India-UK free trade deal and discussions between Modi and Starmer as a good example of people travelling, people talking business and people seeing if we can do a deal. That's been how things have gone for trade for thousands of years, but it's been done. Back to my phrase that one country is retreating, 219 are embracing.

Those 219 really recognise what they had, recognise what they could lose and recognise the value of doing more. This is why I'm imagining a bumper sticker with I love global trade. People are starting to get it.

I commonly say good comes from bad, and I really believe in this case people will really look for new trading partners. Some presidents and prime ministers have been troubling extensively, as you know, talking to governments that they hadn't talked to for 5 or 10 years.

Right. Let me come back to the United States because that is a major export target market for countries like India and many others as well. One of the challenges I'm guessing this time around, which is different from previous challenges, is that it involves paperwork because you have to now collect customs duties for parcels that are coming into the United States.

You have to deal with way more paperwork even for regular imports because one of the things that the United States is checking, exactly to your point, is that stuff going via Vietnam and coming back to the U.S. or coming to the U.S. So how is this kind of challenge from, let's say, previous challenges?

Yeah, so that's good. So de minimis. I think let's start with de minimis, which was the duty-free threshold of 800 U.S. dollars. A lot of countries don't have any level at all already. Some countries, the U.K., are being suggested that they will remove their 135 pound. This will affect the e-commerce industry.

So the U.S. made the change from China and Hong Kong, just for your audience and listeners and a little bit of context on May the 3rd or whatever. And then on August 29, the other 219 countries in the world suddenly have got this zero screen-free level. So you're bringing in the garden hose pipe fitting, the little black dress, the t-shirt.

That is suddenly going to go through an informal customs process that is more cumbersome on us, but we're pushing material through with a very high degree of efficiency and effectiveness. We're being very clear with our recipients or the sender on what the disbursement fee, if we pay duty on their behalf, what the entry fees are, and we're prepared, if so, to return that shipment to origin if someone hasn't wanted it. So I'll say the operational process and the duty collection process, which is enormous.

This is why some post offices suspended service on August 29, whilst they get some sort of system together to make sure they're not liable for the duty. So I'd say it's gone very smoothly from a DHL Express point of view. We never suspended our service into the U.S. for the less than 800 or over 800 now. And I think the interesting thing now is what are the flows like from the world into the U.S.? And we've seen very moderate impact post-August 29. A little bit too early to tell because of National Day and Golden Week and some of the holidays. On October the 13th, China and Asia will be really back to normal and the factories will start up again and we'll be in a better position to see what the post-August 29 situation.

But I would say, you know, DHL are the most international air express company in the world, which means that less than 18% of our volume ends up in the U.S. So we are all things to all people. So we've got as much staying in Asia. Europe to Europe is a huge sector for us.

Asia to me, all these trade lanes are very important, but only 18% was for the U.S. And you can imagine in our industry, there are two great companies and two great competitors, Federal Express and UPS. Their their predisposition and their U.S. lane, Asia-U.S. lane sort of centricity is much higher than ours.

And you're saying that despite or rather post-August 29, the impact at least so far as things stand today in the first or the second week of October has been moderate. It's not been...

Operational impact, good. We've got all our shipments through. Our transit time from the world to the U.S. is just as it was before. The customs clearance process is good. The ADC, Advanced Duty Collection, we tell a customer it's coming to them. Can they pay?

If they don't pay, they don't get the delivery, obviously. That's good. And the impact on our volumes from people saying, I'm no longer going to send this garden hose fitting, this vacuum cleaner from Taiwan to Minnesota, very moderate.

Interesting. So let me come back to the carpet seller that you talked about or the carpet maker exporter from India. So how are they managing?

I mean, at 50%, if that's, I mean, if that's the traditional trade lane they're following, that's like an economic blockade. It's not just an import duty. So how are they managing?

Well, unfortunately, I've got his name and his card and I'll go back and have another discussion. But the impression I got, which is the impression I get from many customers is that they're being very creative. They're doing some sort of pre-ordering bulk order discounts.

If you order more, you know, we'll give you a bit of a discount. They're cutting back some of their own costs to mitigate the 50%. They're taking a bit of a hit on the margin to the U.S. obviously to keep customers there. They're very much hoping that in October, November, it'll go to 25% and it stays at 25% and they lose 25%. This positions them well against Pakistan, against Bangladesh. So this is, I think, by many companies seen as a moment in time that they have to get through it.

And it's very unlikely this will go beyond January 1. So we just got to keep things going and, you know, utilise all the great ways that sales and commercial people have to keep something flowing and use any loophole or opportunity, you know, compliant loophole they can find to keep that going.

And within the DHL Express system, is there a change or shift in the way your staffing and resources are organised to respond to this new world?

Yeah, that's a great question. So the one obvious one is that the aviation assets that we have in Asia, principally China, and the on-the-ground couriers that we have in the U.S., this has changed dramatically. I think the Financial Times published that China-U.S. trade was down 35%. Lower than 800 was nearly 80%. So we need to reconfigure our aviation assets in Asia, move them out to somewhere else, maybe put on the ground higher cost aircraft that we were using in a different part of region, give some back to our partners that were on 30-day, 60-day, 90-day leases. We have a high fixed flex factor in our network.

Our competitors tend to have their own aircraft. We have 70-30. We can give our aircraft back.

Constantly moving around these aircraft to cater to the fact that Asia, and especially China, have slowed down on the U.S. lane. That means we need less couriers and less stops, as we call them, in the U.S., and we've been modifying that every single day. So we've been, a little bit to my presentation earlier today, looking around the corner on what's happening here and making sure we're ahead of the curve, on making sure we've got absolutely the right number of planes leaving Asia with a high weight load factor, which then dictates the CPK, the cost per kilo of those aircraft, and when they land in the U.S., if you bring it down to basics, at the Miami Service Centre, there's a right number of couriers to receive the material that they know is incoming, to have their vans full, and take them out to their customers.

And that will change again, back up. When tariffs change, that will come back up again. I don't expect De Minimis to change anytime soon.

The change has been made, and we now just run with that.

Right. And just on aircraft, you talked about 30-day leases and 60-day leases. That seems very short, I mean, to someone who doesn't know much about this space.

30 days seems short.

Short the lease period for your cargo aircraft?

Well, we want it to be as short as possible, because when something happens, we want to give the aircraft back tomorrow. But by the time things become clear, it's a week or two anyway, we're giving an aircraft back in 30 days. So these events have been announced, and the implications are sometimes a month, sometimes immediate.

And there's a lot of paddling beneath the surface using, moving our tails around, giving aircraft back in the case if we are going to give them back. And we've got great partners that we helped through COVID, and they helped through us through COVID. So I think, you know, we can, that fixed flex factor is very satisfactory for our network.

And the fact that we can move these aviation assets around. Take the China-Vietnam situation, I talked to you about the laptops, that's a whole load of capacity that you do not need in China one night, and you need it in Vietnam, the next night, you know, the next week, at least anyway. So we have to be able to put them there and make sure we're providing good capacity for the demand that is now coming from Vietnam that was coming from China.

So it is what we do, though. I mean, hubs, gateways, service centres, aircraft, vans, IT equipment, that's what we do. That's what we can move around.

Trade always has some interruption. Imagine during COVID, how many changes we were having to make.

Right. And a question which I guess applies to your clients as well as to you. COVID, for example, or the European volcano crisis, I mean, those were crisis.

COVID was a volcano, ash was a shorter one. We had a similar one in Southeast Asia as well. Now, a situation like this makes you change the structure or composition of the organisation that you just referred to.

Now, at the same time, there is hope that things will ease off, change, or maybe if there's a change in the next election, the whole thing could reverse. How do organisations navigate this? Do you change everything permanently?

Do you change them semi-permanently? It's a new state of flux in some way, isn't it?

I think we have a fixed cost network. We have hubs, gateways, service centres that move material wherever they're going. So material moves around the world and it typically moves through the same facilities, through to a gateway, through to a service centre.

From where it came and where it's going to, it's a classic hub and spoke system. So I think we're absolutely okay there. We've talked earlier a little bit about, you know, the flexibility within the aviation network.

But I think there's a more interesting point within your point about as these tariffs hit and companies start doing different things with other companies in other countries, is that going to remain? Water always finds a way. And when this water starts finding a weaker path of sand and the water rivulets start going somewhere else, I think the most interesting question is, will that stay?

And will the lanes they were selling on before become, well, we're not going to go back to that. This is fascinating. Now, I think the only way you could answer whether that's the case is if who they sell to and the prices that they sell at and the margins that they sell at are better in the water flowing, finding the new path will dictate that they may well stay.

So the shifting sands of global trade may change forever. Even if the tariff situation is completely unravelled, the US is a big market, people want to be part of that, I'm sure something will return. But the margins on that market will be different to the margins on selling to Australia and New Zealand.

And in your career, I mean, you've been an express man for a long time. Have you seen something similar? Whether rivulets have become reverse or?

No, I think things have evolved over time, we started off moving small parts for aircraft on ground or vehicle off road, you'll say move it quickly, the aircraft is on the ground, we've got to ship it by DHL, it'll cost a lot of money. This was the 80s and 90s. Now we're firmly part of someone's supply chain.

So we've seen lanes evolve over time. But Europe has always been a very big lane, Asia or Asia have been a big lane. Well, one I could say now that's also happening is business into the Middle East.

The Middle East is really booming on the back of Saudi Arabia and Dubai. And Asia is shipping heavily to two things are happening actually in Asia shipping heavily into Middle East. That's interesting.

And that's a strong shift. But Asia, China is also shipping heavily into ASEAN countries. Now this sounds good.

But if that becomes an over supply and price dumping and so on and so forth, there may well be too many Chinese goods flooding the ASEAN markets that are definitely happening in a positive way at the minute because they're not going to the US. And ASEAN are consuming those things. But does that mean Malaysia starts consuming inbound Chinese product or their own manufacture?

I think that's interesting dynamic that one would have to watch. ASEAN 50 years ago were countries fighting against each other. It was one of the most successful trading arrangements that's ever been created.

And we hope ASEP, the regional corporation ASEP agreement will turn out to be successful. But ASEAN has really kept those nine or 10 countries trading with each other and talks to how people see the merits of global trade and how global trade can help country prosperity and keep inflation low and keep GDP high.

And you mentioned Middle East and Asia. What are the other trends that you're seeing in this region in particularly in the kind of products that are moving or the kind of business that you are seeing?

Well, I think in this region, by which you mean India, maybe. Including India. Including India.

I don't think there's been such a change. Electronics, you know, the whole sort of data centre thing is a big thing. The hyperscalers are moving these massive data centres or establishing these massive data centres.

You know, Malaysia is a big beneficiary of anything in electronics and electricals and so on and so forth. There's a lot of technology related movements that some of those countries that we call geo tailwind countries, Philippines, Malaysia, India, Thailand, there'll be the beneficiary there. China plus one countries.

Chinese companies move, not moving out, but expanding out of China to get closer to their market. Great example of a water heater company setting up in Egypt and Thailand. I rang the general manager of those countries.

Yes, they had them on their prospect list. Yes, they had set up some capital in the country. And yes, they were going to be producing water heaters in Thailand and in Egypt.

This is fantastic global trade on a plate. So, I think we've seen, you know, moves of that nature in India. You know, India's on a strong roll.

I get the impression they're making all iPhone 17s. I don't know whether that's technically correct. But life science and healthcare is very strong.

EV and automotive is very strong. So, there's some industries and some countries that are stronger than others. But we're targeting life science and healthcare under the banner of health logistics.

We've been very much into EV, but that now fits under a new initiative called renewables and new energy. So, not oil and gas, but dealing with those organisations that are involved in new energy. It's an emerging sector.

It hasn't just been around for a week or two, a few years, but it's, you know, slow progress on some of these things. So, we're investing heavily in that. We're investing heavily in health logistics and we're investing heavily in this GT20 concept and putting the best possible assets in these 20 countries.

Quickly filling the white spots or capability gaps that we might have in these companies. Establishing cross BU warehousing or thermo cold chain solutions to make sure that we're first in, best dressed to get the growth in these markets that are forecast to grow faster than anything else. And the last comment I would make on this particular question is, we placed 40 Chinese sales people all over the world.

So, as a Chinese company lands in Egypt, the first person they're going to see off the plane is a DHL Chinese salesperson that lives there. How can I help you with your logistics? What is it you're going to need?

Is it a warehouse? Is it manufacturing? And I can coordinate everything for you.

So, they see a friendly face for want of a better phrase, as soon as they land in Egypt or South Africa or Indonesia or Malaysia or the 40 cities where we have, this is a new phenomenon. There wasn't one a year ago. So, moving quickly is very important here.

And China plus one is a positive phrase. So, everyone leaving China is Chinese companies setting up outside of China as well as inside. It's Siemens saying we're going to be in China, but we're also going to be in Indonesia or Malaysia.

So, I say this to Chinese journalists, it's entirely a positive thing. It's not because China plus one had a bit of a stigma to it that was negative. But this is Chinese companies who want to sell product overseas.

And we're going to come to renewable energy as well as health in a moment. You talked about Egypt. So, is Egypt now, amongst others, a new manufacturing base, which will also export or is it more domestic market?

It's a hub for, it's becoming more of a sea hub for North Africa or Africa. It is a manufacturing base of some commodities. It is emerging through its various cycles of modernisation.

It is a country that we identified as one of the GT20. So, Egypt is predicted on a scale, it's quite big already, and speed axis to grow faster than the other 200 countries that aren't in the GT20. So, I think it's a very positive environment.

The other thing that's happening, the other interesting thing that's happening with Egypt is a very strong connection with Turkey. So, we're placing a Turkish overseas salesperson in there for three months to establish how he can Turkish companies deal with Egyptian companies or set up there. It's just one of those markets that's quite exciting.

Will it be dramatically different in 10 years? Quite possibly so. Is it the hub and entry point for North Africa?

Becoming so. It is more Middle East, North Africa as opposed to sub-Saharan Africa. There is a line of demarcation there on the continent.

But yeah, I think it's quite exciting what's happening in Egypt in a different way to what's happening in Saudi, in a different way to what's happening in Dubai or Turkey. You take those four GT20 countries in that region, they've all got different prospects.

The example you used was of a water heater company. And I'm guessing that if you're in India now and a business which is somewhat flexible, one should be looking at these markets, including as manufacturing basis.

Yes, a hundred percent. I think they're looking to get closer to new customers, establishing whether those markets, Egypt and Thailand in case of the water heater, but others in the case of India, can be a satisfactory manufacturing base. And why I'm so positive, maybe overly so about the national logistics policy is because it's a force for good and it's driving the right things to make companies consider India for a manufacturing and international distribution base, as simple as that.

And companies have absolutely selected India on that basis. And when I look at our infrastructure and the airport set up and so on and so forth, it takes time, but it's progressing. And it was very much a stated aim that it wanted to do so.

Right, so India is on a journey to increase or expand its manufacturing base. It's been a somewhat slow journey for various reasons. Again, from your vantage point, what are the things that we should be doing better or could be doing better or more to ensure that we grab a larger pie or other stake in the pie or a piece of the manufacturing pie?

I think policy change has got to be quicker. General policy, I can't talk to specific policies, but policies that assist inward investment, being sure that they're going to get here what they really bargained for. So policy change is important.

Include increasing digitalisation and AI of container seaports and other infrastructure in the country. Export and import regulations and policies on duties and things like that has to be clear, has to be more of a digital environment supporting that. Can't have packages waiting 10 days for customs clearance and so on and so forth.

Not saying that's what's happening in India because has been progression. And when we were up in New Delhi last year, we saw a very nice facility in a very modernised area. So I think that they're working through the right things.

There's always some distractions along the way. But Rome wasn't built in a day. And India are firmly recognising what China is doing and what China's done.

And they don't seek to be the next China. But I think they found a niche for themselves and a set of industries, heavily AI and digital and technology related with the massive amount of labour they have that's very skilled in that area, but also a strong manufacturing base.

You talked about new energy and is this investment or are these investments in the context of your own fleets and your own delivery infrastructure or is it?

It's more positioning ourselves to have customers consider the capability that we have, the functional footprint of DHL, right through from express to air, to sea, to warehousing, to industrial projects. It's having customers recognise our capability. There is some investment there in equipment and so on and so forth.

But you're moving a complete turbine system, you're probably renting a certain truck for a day or two or three, using your own equipment wherever you can. So I think it's less an investment in technology and infrastructure than an investment in people and capability to manage these big projects. When I talk IP, industrial projects, dedicated business unit, when I talk renewables, somewhat linked to IP, when you're moving some of these things, it is an industrial project in itself.

In my division, we sort of move the nuts and bolts and the white glove stuff that makes someone finish it off and it goes round and the testing is done and maybe there's a spare part that's broken and we ship that in. So what express does for renewables and data centre logistics is quite different to what global forwarding and supply chain does for these particular projects.

Data centre is an interesting theme because we are in the middle of an AI rush or madness, depending on who you ask. So how are you seeing that? At one level, chips are moving, valuations are going sky high.

At the same time, there's a lot of investment going in. How are you calibrating for this?

Yeah, I think there's the internal aspect and the external aspect. We can't get too excited. So on the external aspect, we need to understand which customers is affecting, whether we've got the right capabilities to service them, whether we're known to them and make sure that we can satisfy the customer requirements by this rather exciting, swift set of developments.

In terms of AI and how we can use it in our business, we need to be also quite practical to how we can put that in, how we can not be distracted by it and how we can benefit from it. A good example, we're working with a company called Cognigy in terms of agentic AI, moving beyond interactive voice response and chat bots and global virtual assistant into real agentic AI discussions. Where is my package?

Can I change the address? Can I pick it up from a service centre and making our customer service much more efficient? So I think we're ready for the data centre moves and the things that it's precipitating on our customer side and we're ready internally, but being quite practical about what it means to everyone.

So internally, would you say that the returns that you're seeing or the impact that it's having, the investments on in and around AI is now?

If we were sitting here in 12 months time, I'd be saying 100%. We've got big projects on customs classification, the DGF. We've got big projects on hiring for supply chain, how you hire people.

This is a division that needs to find a thousand people in three days. We've got big work stream initiatives on where's my package? Can I change it in a rather more sort of traditional ones in Express?

Our AI story is exciting, but it's just speeding up the types of questions that we got before. Whereas customs in DGF and hiring people via AI, someone not talking to a human being, but having a good discussion is actually quite a lot more exciting, if you will. So no, I'd say now, but definitely in six months, you'll find a lot of countries really utilising these concepts for efficiency.

Last question. So we're heading to Christmas in a few months, also a litmus test for buyers, sellers, shoppers, and logistics companies. So how are you seeing Christmas this year?

Yeah, well, Christmas comes every year and peak season comes every year. Describe it as a hockey stick. Sometimes the hockey stick is in someone's hand and being played and it's almost vertical.

That's a big peak season. Sometimes the hockey stick is just maybe lying on an old boot or something and elevated at a lower level. So there will be a hockey stick of elevation already seeing it going into peak season, Christmas, end of year, etc.

Maybe it's a little bit more subdued than two years ago. There was a peak season last year. We have a demand surcharge, which is industry standard.

Our customers have a demand surcharge. The extent to which we recover from that demand surcharge will rather be dictated by the demand. It's called demand surcharge for a reason.

But there's no doubt that capacity is tightening up as we speak. And the peak season is underway in terms of its planning. And our job is to deliver a good peak season from a quality point of view.

That's the real job of our teams in the next 12 weeks or whatever it may be, is to deliver a great quality for customers who want to use us during peak. How much the hockey stick is elevated and how much business comes to us will remain to be seen. But in my 39 years of DHL Express, I've never seen quarter four not bring a strong elevation of business.

Tariffs or no tariffs. Wonderful speaking with you.

Thank you. It's always a pleasure. Interesting topics to be talking about right now.

This week on The Core Report: Weekend Edition, Govindraj Ethiraj speaks with John Pearson, global CEO of DHL Express on how India can grab a larger manufacturing share with quicker policy changes, clearer trade rules, and digitalised ports.

Zinal Dedhia is a special correspondent covering India’s aviation, logistics, shipping, and e-commerce sectors. She holds a master’s degree from Nottingham Trent University, UK. Outside the newsroom, she loves exploring new places and experimenting in the kitchen.