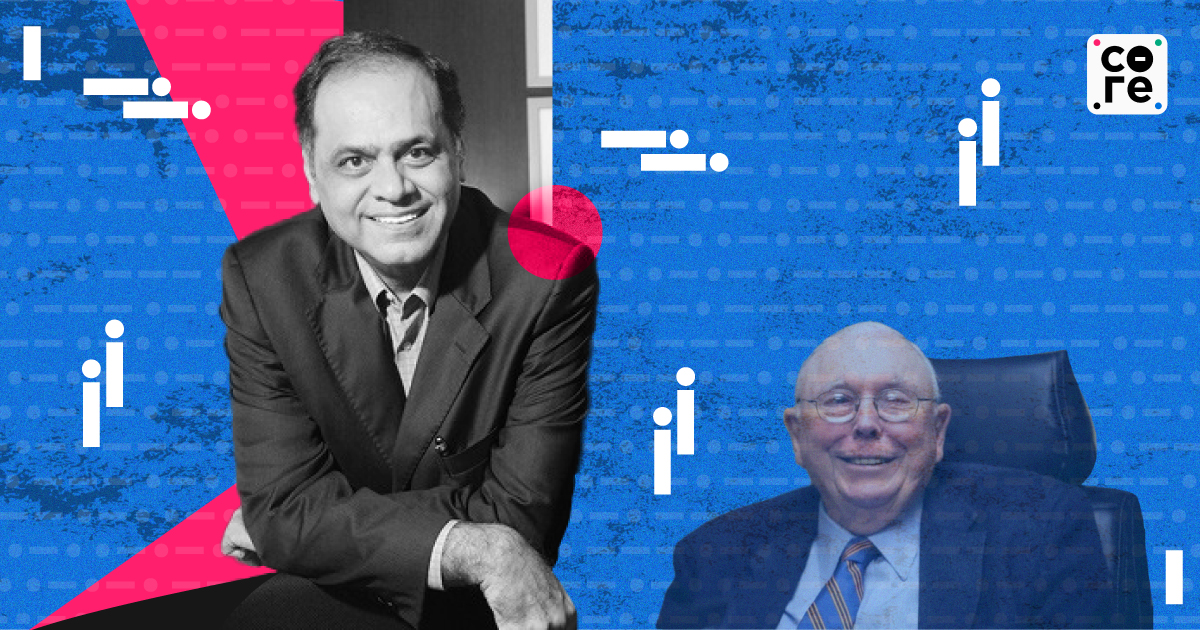

Charlie Munger Taught Value Of Compounding In Investing: Veteran Investor Ramesh Damani

Munger's many achievements included pushing Buffett into big bets on Chinese battery and electric vehicle maker BYD and Iscar, an Israeli machine-tool manufacturer.

Charlie Munger, the former vice-chairman of Berkshire Hathaway and the investing legend Warren Buffett’s partner and friend, who died last week began managing investment partnerships in 1962. From then through 1969, the S&P 500 gained an average of 5.6% annually. Buffett’s partnerships returned an average of 24.3% annually. Munger’s did even better, averaging annualised gains of 24.4%, according to The Wall Street Journal.

Munger died at 99 in a California hospital. His many achievements included pushing Buffett into big bets on Chinese battery and electric vehicle maker BYD and Iscar, an Israeli machine-tool manufacturer.

“I think we learned directly from Buffett and Munger, that even a man of modest means of modest stock picking abilities, if he remains invested in winning stocks, that compound over 20-30 years, can transform a middle-class life into a fairly generous and rich life as a matter of fact, thanks to the power of compounding,” veteran investor Ramesh Damani told The Core’s Govindraj Ethiraj in an interview.

According to Damani, one of Munger’s most impactful teachings on investing was the value of compounding. “(He taught) what's compounding and how compounding of anything, whether it's money, whether it's knowledge, or whether it's behaviour, whether it's reading, you do a little bit every day and get a bit smarter. Over a 20-30 year period is an enormous payoff in doing that,” Damani said.

Edited excerpts:

There is much to be learned of and about and much to be said on Charlie Munger. Where would you like to start? What's maybe the first time you saw him? What did you take away?

Well, I met him many years after I started following him. I've been following him almost since I was in college, I had first heard of a company called Berkshire. In 1977. when I went to America, the price was maybe $75 at that time and over the years, I've come to realise what an instrumental part Charlie Munger (played) in the building of Berkshire. And I think the only tribute I can pay him is what historian Henry Adams said, that a great teacher lives in eternity, because you never know where his influence stops. I think manga has influence on not only investment, but psychology, corporate governance, the China crisis, the Middle East wars, is permanent and long lasting. I think his influence will be felt, as the code said, for many, many generations to come. So here has also been personally a very profound influence on my investing life.

If you were to pick, what would be the first thing you took away from him, which would in some ways also have contributed to the bedrock of your investing approach?

Well, I think the first thing is, Charlie Munger is very clear, the clarity of thinking and the ability to call a spade a spade is truly extraordinary and remarkable. And so many complex issues in the world, global warming, Bitcoin, corporate governance, decorative accounting, which I didn't know much about, I listened to Charlie Munger his view, and realised that was the correct view to have you already distilled everything. And as Warren Buffett said, when you ask him a question, before you finish, he's already figured out the essence of the problem you are facing. His ability to get to the core of the issue was extraordinary. In terms of my investing career, of course, I was more basic. I wanted to learn the virtues of compounding, and how to look at problems.

And what Charlie Munger taught us was that if you can't solve a problem linearly, try and solve it algebraically, which is in reverse. If you can't decide who you want to marry, decide who you don't want to marry, what are the qualities you don't want to look at a spouse, and then find someone exactly the opposite.

Munger has been a defining influence, not only in my life, but in (the lives of) three generations of Damanis. Myself, my son. And even my six-year-old knows the formula of Charlie Munger. And I could tell he was very puzzled to hear about his death.

Your six year old grandson, you mean?

Yes, my six year old grandson. My son of course has a statue of Munger for many years in his office. And in fact, one of the firm's that he runs is called Lollapalooza Investing because Munger said that all investing is a combination of various factors, be it engineering, psychology, medicine, and compounding. And so he took the name and we actually have a company called Lollapalooza Capital.

That's interesting. You talked about elimination damage. What's a good illustration of that in, let's say, maybe a stock or a sector you would have purchased, we would have actually arrived at that by eliminating rather than sort of direct selection?

I think the best example is after the tech boom in 2000, there was a huge boom I felt in the BPO (business process outsourcing) , or the KPO (knowledge process outsourcing) industry, where I felt a lot of the employment would come across, but I was very hard pressed to figure out which companies would participate in it.

When I first looked at the broad picture, I said, what is going to be the size of the KPO-BPO market in 10 years. And there were some reports that seem to (say) $20-$30 billion. They were trying to figure backward which companies can make a run of it. Which company has access to talent which comes with access to processes, which companies (have) access to western markets, and from there I got directed to a company that was called Isa at that time, which ultimately got merged with TCS. I felt that would be a good business to start with. And amazingly enough, the stock did pretty well after that.

I use him informally all the time. If I can't answer a problem linearly, I try to look at it backwards and say, here's the solution now. How do I get back to the elements of the answer? The other thing that we offer almost infinite debt of gratitude to Buffett and Munger is to understand what's compounding and how compounding of anything, whether it's money, whether it's knowledge, or whether it's behaviour, whether it's reading, you do a little bit every day and get a bit smarter. Over a 20-30 year period is an enormous payoff in doing that, in terms of money, you can borrow money every three years, in 30 years, your money grows up 1,000x.

I think we learned directly from Buffett and Munger, that even a man of modest means of modest stock picking abilities, if he remains invested in winning stocks, that compound over 20-30 years, can transform a middle class life into a fairly generous and rich life as a matter of fact, and that, thanks to the power of compounding that Warren Buffett and Charlie Munger taught us.

You did say and imputed as well, that when you go to Omaha, you are in a learning mode. But tell me an instance, where let's say you had a certain preconception or a conception of something, which you felt was a rock solid business, or a sector. And you changed your mind. And you had to really work hard to change your mind because of something that they said.

Munger always used to say that to get the success you deserve, you have to deserve the success you get. A lot of times, for example, I miss out on a very big trade. I wasn't ready, or I didn't act decisively enough. And I think the answer that came back to me is perhaps I didn't deserve the success at this point. One of the attributes that Munger taught us, just to get us give a snapshot of what he did in his life, is that he took $10-$20 million, he added the daily commerce journal that he ran, and didn’t invest it for 20 years or so, till he found the perfect investment after reading a column, put that money in there. And that went up three or 4x. And then they give that money to Lilu, and that he moved up 10x. So you made 10-20x return for their money, that $40 million ultimately became $400 million. So he said, great opportunities are very rare. But when they come, you have to back up the truck and buy it, don't buy the symbol, buy with the bucket at that time.

I think that's always stuck with me. Of course, that is easier to express as an idea than to do it in reality. That's why he's Munger and I'm Ramesh. But I hope somewhere in my career or through my teachings, someone will learn when the opportunity comes to, back up the truck and buy it, because the Indian market also has had tremendous opportunities over the last 30 years.

I'm sure those opportunities will come. When you look at the opportunities that you've seen in India, versus let's say, the kind of opportunities you've seen there, and sometimes novices might ask this question, that the US market is different, the Indian markets are different, companies operate differently, tariffs operate differently, barriers to trade operate differently. Is that something that you've ever encountered as a question? And how have you answered it to yourself?

I did, but I think they've been disproved. For example, one thing is that in Indian markets, you can't make the kind of money you can make in western societies because you're dealing with rupees instead of dollars. But when you look back and study the history of Infosys and Wipro, they've compounded over 30 years, at periods compounding rates were greater than 30-35%. And dividends also compounded at a fairly superior rate. So you've had great stock picks in India that have done and built wealth over long periods of time. That answers that question.

The other question we always had is that, perhaps the US market is very efficient, and you can't make money in the US market, but if you look at the last 10-20 years, companies like Google, Facebook, Nvidia, they all came from basically small-cap stocks to become mega caps over a period of time, including, of course, Amazon. I think opportunity abounds every day in the market because human nature doesn't change. We move from fear to greed. And I think what Munger and Buffett taught us was that we should take advantage of that and use volatility as a friend. And only risk is the loss of capital, not the volatility that is inherent in any stock selection.

You referred to what I would broadly call geopolitics because you mentioned the middle-east and so on now, and how Munger would look at it, and what's the what's the learning there? These are all recent events and yet they could affect, though they've not really affected this time, but tensions like this or geopolitical tensions, which a lot of people are talking about now, as having a play on markets and stock prices, how would he have looked at it?

He had surprising views on it, for example, global warming. Which is now, the rage of all discussions, how it affects the economy, how you invest ESG. Charlie Munger is on record saying that the concerns about global warming are overblown, that if the temperature goes up by half a degree or one degree, human beings will learn to survive and do well even in that kind of environment. Regarding China, there's been a big thing about trade barriers and how China's doing this and that and Munger’s often of the view that we should try and be friends with China, America and China should try and be friends. In fact, he pioneered one of the iconic investments in Berkshire Hathaway in a company called BYD, which is based in China, and the CEO of BYD called the new Thomas Edison. He was very open minded about things.

On the other hand, he always called accounting treatments that were given to derivatives as sewage, and he said that was an insult to sewage. And in matters of Bitcoins, he says that they should be banned in matters of active trading. Now in India, we're seeing a huge upsurge in option trading. He calls it the most useless form of activity, and that he wouldn't bother with it if governments had banned active trading and options and futures. So very unconventional views.

But if you always listen to him, he is always very rational. One of his big heroes in life was Benjamin Franklin, who was an author, ambassador, poet, and scientist. And he always said, emulate the simplicity of Benjamin Franklin's thinking. Benjamin Franklin followed the principle that money is not particularly good, because the more you have it, the more you want it. And despite his stature as vice chairman of Berkshire Hathaway, he was worth only a modest $2 billion or so compared to Warren Buffett's $100 billion, and he's very anxious to give away also that, so I think there's a lot to learn from his life and legacy. And that legacy will rebound over many, many generations to come go with.

I think the BYD example is a good one. Because I mean, it took a long time for that investment to turn around. And who could have, in their wildest dreams guessed that this Chinese entrepreneur would suddenly become a force. And everyone was obviously looking at Elon Musk.

You're right. The other point is that Buffett has also paid tribute to Munger and so would I. Buffett was in the occupant of this Graham and Doddsville village of value investing, where you buy companies for net net cash, no matter what the business was. Munger was the first guy who prodded Buffet to move to buying a wonderful business at a fair price, rather than a fair business at a cheap price. He pushed the envelope and made Buffet buy Coke and buy Wells Fargo. He said they're great businesses, and the cash flow over the years will more than make up for the better price you're paying. The power of the brands and the power of looking at a good investment was Munger’s most incalculable contribution to Buffett. And Buffett himself has acknowledged that.

You talked about long-term investing, looking at something for 20-30 years, and that really is about longevity, and Charlie lived up to 99. Of course, he may not have known that he would live till 99. But in retrospect, it appears that he could have bought stock at the age of 60. And then held on till he was 90, and so on. I mean, it's tough, people don't have that ability to think so long term. And can you train yourself? To think 20 years and 30 years because we're all mortal. And how do you bring these two almost disparate forces together at one level, the mortality and the other is the absolute power of the market to compound and deliver to you those amazing returns that you just talked about?

I think it comes naturally. Either you're born with it or not born with it. I was with the dream that propelled long-term investing and as my career has further enhanced it and I believe my next generations will also do that. Either you get it or you don't get it. Some people want excitement and they want the trading and the quick profits and they do that, but they can generate income for themselves but rarely wealth themselves. Wealth is generated by not paying the bit in difference everytime, not paying the brokerage, not paying the taxes, but the remaining invest in high quality businesses. The dividends in Coke, for example, account for almost two-thirds of almost 35% of the value that has been created by Berkshire's investment in Coke. I think it's something you either get or you don't get it. Obviously, Munger had it in spades. And a lot of I'm part of the religious cult that believed in Mungerism. Great businesses take time. Rome wasn't built in a day. Neither are great businesses.

When did you last get to see him? And what was that experience like?

I've been, of course, like most, solid brokers to Omaha, for the Woodstock capitalistic event, as Buffett called it, and at that time, used to sign autographs for the foreign delegates, of which I was one. I met him for a few seconds in person. Unfortunately, I didn’t have the pleasure of interviewing him or meeting him beyond that. But of course, his work lives on as his legacy. And if I may, end this with the following quote about Charlie Munger. It has been said that, for those of us who knew him, of course you'll miss him and for those of you who didn't know him, I'm really sorry for your loss.

Munger's many achievements included pushing Buffett into big bets on Chinese battery and electric vehicle maker BYD and Iscar, an Israeli machine-tool manufacturer.