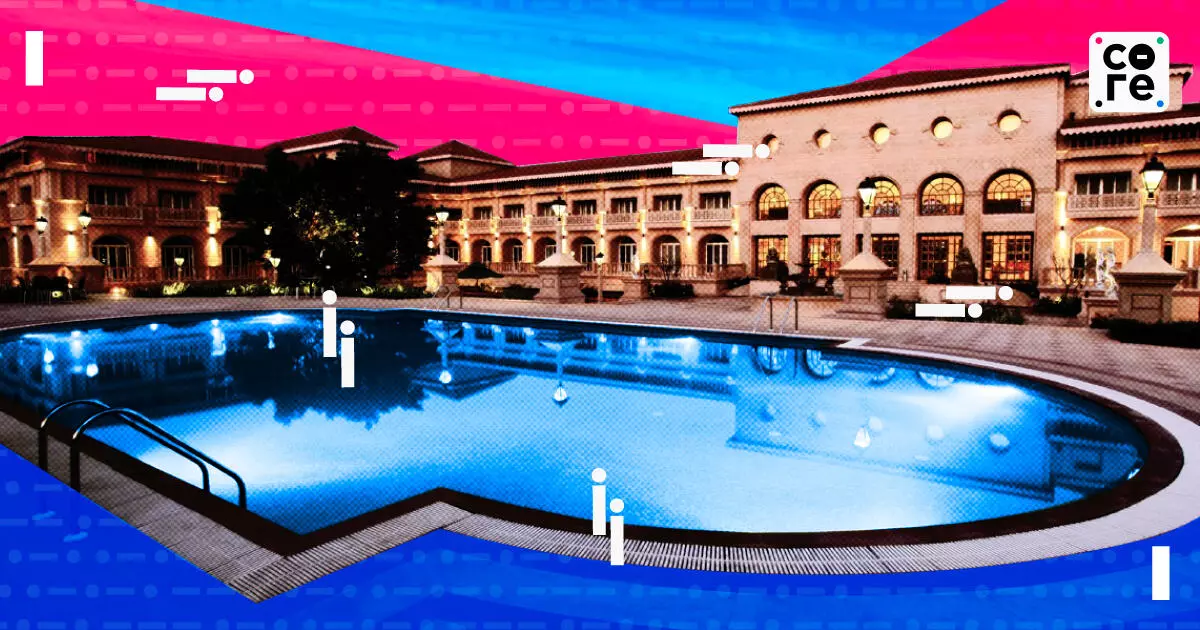

Indian Top Tier Luxury Hotels To Beat Oversupply Blues In 2026

As room inventory surges in secondary markets, a lopsided demand-supply gap in major cities is shielding the industry’s elite players.

The Gist

- High barriers to entry in the luxury segment ensure continued pricing power for top-tier hotels.

- Analysts predict an upcycle lasting 2-5 years, driven by stable corporate travel and rising room rates.

- While foreign tourist arrivals remain below pre-pandemic levels, the domestic travel market is significantly larger and thriving.

Entering 2026, India’s luxury hotel industry is in for a much better year. While 2025 was defined by a disruptive monsoon and the stabilisation of post-pandemic revenge travel, the coming year is expected to be a period of strategic resilience. Although many owners are currently navigating rapid expansions launched during the boom phase, emerging demand drivers and a robust corporate travel landscape are expected to insulate top-tier players from the stress of new supply.

Most hotel owners anticipate a steady year ahead, underpinned by a structural demand-supply mismatch that is expected to protect both margins and revenues. According to a CRISIL report, the sector’s revenues are projected to grow by 13–14% in FY26, followed by an 11–12% rise in FY27.

“In 2025, we haven’t seen a rise in occupancy, but we have maintained consistent performance, typically in the 60–70% range across most months. While there hasn’t been an upward movement, the positive takeaway is that we have been able to hold occupancies at last year’s level,” said Akhil Arora, CEO & MD of Espire Hospitality Group.

Supply-Demand Dynamics In Favour

Market forecasts suggest that occupancy will stabilise at a healthy 74–75% level, indicating that the market can absorb incoming inventory without compromising pricing power. Significantly, the bulk of new supply is concentrated in Tier 2 and Tier 3 cities, leaving metros and top-tier markets with highly favourable dynamics.

“While overall supply is expected to grow at around 9.6% compounded annual growth rate (CAGR) over FY25-30, the top 20 markets are expected to register supply growth at around 6.9% CAGR. Supply growth for metro markets is expected to be even lower at 5.4%,” noted a report by Yes Securities.

Data from Systematix indicates that the top 10 cities will account for only 31% of the upcoming inventory. The highest concentrations of new rooms are expected in destinations such as Amritsar, Chandigarh, Dehradun, Lucknow, Navi Mumbai, Noida, and Udaipur.

“Some of these markets are likely to witness short-term over-supply, leading to heightened competitive intensity and, as a result, muted RevPAR (revenue per available rooms) growth,” Yes Securities added.

Luxury Market To Sustain

Because the majority of the new supply is concentrated in the midscale and economy segments, luxury players in top cities have retained significant headroom as well as pricing power. According to a JM Financial report, the total demand for luxury rooms is estimated to grow at a CAGR of 10.6% over FY24-FY28 against supply growth of only 5.9% over the same period, as per J M Financial report.

“Going forward, supply in the luxury segment is expected to remain constrained due to high barriers to entry, including limited availability of land, extensive regulation, restrictive zoning, high cost of capital and long gestation periods,” said a report by JM Financial.

Most sector analysts believe that the upcycle in the hotels sector can sustain for anywhere between two and five years before supply catches up with demand. Growth is expected to be driven by growth in room rates as occupancies hold steady in the coming year.

With the government’s focus on driving higher consumption, visible in tax rates and GST cuts, we believe the tourism sector to be a key beneficiary,” said B&K Securities. While the government cut GST only on budget hotels from 12% to 5%, the overall boost is expected to boost consumption, also aided by a cut in income tax rates in early 2025.

Business Is Up In The Air

There are triggers for steady demand in the coming year as well. While revenge travel since the pandemic has faded, new growth avenues have emerged, such as meetings, incentives, conferences, and exhibitions (MICE), which have become a stable base for occupancy.

“For the year 2025, occupancy levels have been gradually improving from 2024, driven principally by strong demand within our corporate segment, increased events, and an upsurge in international travellers. We have also benefited from repeat corporate clientele and longer-stay guests that contributed a stable base throughout the year,” said Vinesh Gupta, general manager at The Den in Bengaluru, which has seen 25% growth in average daily rate (ADR) in 2025 despite flat occupancies.

In the coming year, growth in global capability centres (GCCs) is expected to structurally lift corporate travel in general. Not only does corporate travel provide steady returns, it also boosts offseason occupancies, keeping the sector in good stead.

“Rates have not gone up in 2025 due to various market fluctuations that we witnessed. Rates in 2026 may slightly go up, based on the cordial market situation and demand,” said Arora.

For Love & God

Even domestic travellers are changing their tracks, which is expected to sustain demand in the sector. Apart from corporate travel, weddings are also providing a steady seasonal demand – with Indians’ love for destination weddings has become mainstream, both amongst resident Indians as well as diaspora.

“Post-pandemic, weddings averaging 350-400 guests generated Rs 25-30 million per event for luxury hotels, accounting for nearly 50% of the total destination wedding expenditure. Preferred luxury wedding destinations such as Jaipur, Udaipur, Goa and Delhi continue to witness strong traction from high-spending Indian families,” said B&K Securities.

Then there is an emerging ‘asset class’ of spiritual travellers too. “Ayodhya, Rishikesh, and Puri are witnessing meaningful supply additions, supported by rising year-round footfalls and improved infrastructure connectivity. This segment reduces seasonality risks often associated with traditional leisure travel,” said Systematix.

Hotels are also honing their offerings with unique experiences for travellers. “Today’s traveller is more conscious of sustainability, more curious about local culture, and more inclined to seek well-being in every journey. A holiday is no longer about ticking destinations off a list, it’s about slowing down, immersing in the spirit of a place, and taking home something that enriches the soul. This change has pushed the hospitality sector to innovate beyond traditional luxury,” said Arora.

The Mindful Traveller

To aid personalised, experiential stays that aid purposeful travel, hotels are holding events like curated dining experiences, wellness-led stays, local cultural immersions, and bespoke celebration events.

“Travellers lean towards flexibility, sustainability, and authenticity, influencing how we shape our offerings. We innovate with new experiences/offerings and selectively invest in capex for areas such as room renovations, tech upgrades, and F&B concepts. We are strengthening our wellness, F&B, and lifestyle programming to appeal to discerning modern travellers seeking an enriching experience,” said Gupta.

These moves also aid margin growth, which is equally important as the sector is missing its valuable foreign travellers; as their spending on food and beverage is higher. Thanks to geopolitical tensions in the Middle East and more, as well as slow growth across various economies, has ensured that foreign tourist arrivals remain lower than the pre-pandemic levels. As of 2025, their arrivals are only at around 90% of 2019 levels.

Outbound Travel Troubles

With fewer foreign travellers on one hand, a few factors might also pull away the evolved Indian travellers out of the country. High-end leisure travellers who normally land in Goa or Jaipur might be pulled away by neighbouring countries.

Countries like Vietnam, Thailand, and Sri Lanka, which currently offer cheaper room rates, easier visa norms, and improved connectivity, might hold higher attraction. If domestic prices go up any further, some of the demand might shift to other locations.

Yet, hotel owners take comfort from the size of the domestic travel industry. The number of domestic travellers is 60 times higher than that of outbound travellers. Also, experts point out that more trips to Dubai and other destinations indicate higher disposable incomes, but don’t point towards substitution.

“Outbound travel poses no material threat to the domestic sector. International leisure travel is unlikely to materially cannibalise domestic demand,” said Systematix.

As room inventory surges in secondary markets, a lopsided demand-supply gap in major cities is shielding the industry’s elite players.

Rohini Chatterji is Deputy Editor at The Core. She has previously worked at several newsrooms including Boomlive.in, Huffpost India and News18.com. She leads a team of young reporters at The Core who strive to write bring impactful insights and ground reports on business news to the readers. She specialises in breaking news and is passionate about writing on mental health, gender, and the environment.